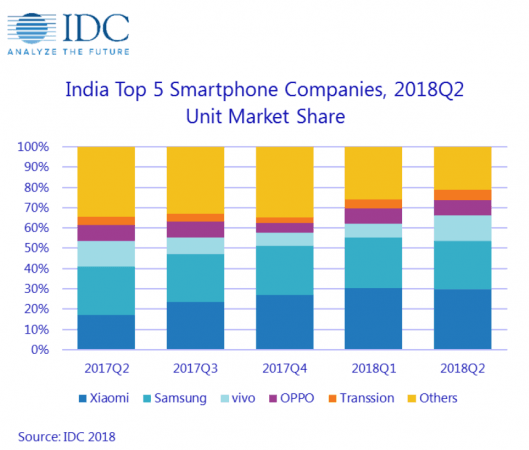

It looks like there is no stopping Xiaomi in India. After dethroning Samsung as the numero uno mobile brand in Q4, 2017, the Chinese smartphone company continues to grow and has managed to double its shipments Year-over-Year (YoY) in the last quarter as well.

As per the International Data Corporation (IDC) 2Q 2018 report, Xiaomi grew 10 percent quarterly and 107 percent annually due to its increasing presence in the offline business. Four smartphone models captured the top four slots in top models ranking, together accounting for 26 percent of the overall smartphone shipments.

Former leader Samsung has secured the second position in the smartphone market. The tech giants witnessed a healthy 21 percent YoY growth following the newly launched 'Infinity Display'-based budget models such as Galaxy J6.

Other low-end models -- Galaxy J7 Nxt, Galaxy J2 (2017) and J2 (2018) -- also drove the overall volumes. The high-end segment (US$500 and above) saw incremental demand with cash back offer.

On the other hand, Vivo made come back to the top three with strong shipments of budget Y71, V9 and Y83 series smartphones. The company witnessed an 18 percent YoY growth. Its Chinese peer Oppo dropped from third to fourth over lacklustre marketing activities, IDC noted.

Transsion Holding- owned subsidiaries Infinix Mobile (online brand) and Tecno Mobiles (offline brand) grew 26 percent and 45 percent respectively and helped the parent company finish within the top 5.

"The market, however, is seeing rapid consolidation at the top end, as the top 5 vendors made up 79% of the smartphone market in 2Q18, marginalizing smaller brands," says Upasana Joshi, Associate Research Manager, Client Devices, IDC India.

Overall, the Indian smartphone market witnessed 33.5 million unit shipments in Q2, 2018 as compared to 28 million unit same period last year, thus recording 20 percent YoY growth.

| Brands | 2018 Shipments Volume (in millions) | 2018 Q2 Market share | 2017 Shipments Volume (in millions) | 2017 Q2 Market share | Year-on-Year growth |

| Xiaomi | 10.0 | 29.7% | 4.8 | 17.2% | 107.6 % |

| Samsung | 8.0 | 23.9% | 6.6 | 23.6% | 21.3% |

| Vivo | 4.2 | 12.6% | 3.6 | 12.8% | 18.0% |

| Oppo | 2.5 | 7.6% | 2.2 | 7.9% | 15.2% |

| Transsion Holdings | 1.7 | 5.0% | 1.1 | 3.9% | 53.0% |

| Others | 7.1 | 21.3% | 9.7 | 34.6% | -26.8% |

| Total | 33.5 | 100.0% | 28.0 | 100% | 19.8% |

As far as the feature-phone is concerned, it registered 44 million unit shipments in 2Q18, seeing a growth of 29 percent over 2Q17. Reliance Jio, the telecom operator and the main driver of the 4G feature phone segment with its JioPhone range of phones, remained the top vendor in the overall feature phone market. However, the 4G feature phone market saw a slight decline of 10 percent QoQ with 19 million units. This drop is due to JioPhone inventory buildup from 1Q18, IDC noted.

With the launch of Monsoon Hungama offer and soon-to-be-released JioPhone 2, feature phone shipments are expected to pick up. Other brands are expected to lose out to Reliance JioPhone's 4G capabilities, in addition, to support for YouTube, Facebook and WhatsApp other feature-rich apps.