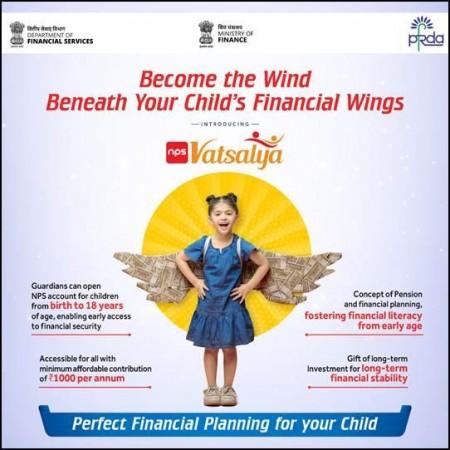

In a significant move to secure the financial future of young children in India, the government has launched the NPS Vatsalya pension scheme, which offers flexible contributions and investment options for parents or guardians.

Announced in the Union Budget 2024-25, the National Pension System Vatsalya (NPS Vatsalya) scheme is designed exclusively for minors, marking a significant advancement in financial planning.

The scheme not only will secure the future of its young citizens of the country, but also foster a culture of savings from an early age.

What is the NPS Vatsalya scheme?

The NPS Vatsalya scheme is a saving-cum-pension scheme, which will be regulated and administered by the Pension Fund Regulatory Authority of India (PFRDA).

Under the NPS Vatsalya scheme, parents can invest a minimum of Rs 1,000 per month with no upper limit.

The scheme will be operated by parents until the child reaches 18. At the age of 18, the account will transition into the child's name.

It can then be seamlessly converted into a regular NPS account or another non-NPS scheme.

The NPS Vatsalya scheme also allows for flexible contributions to the account by giving guardians the choice to select from a variety of pension funds for managing investments.

The Moderate Life Cycle Fund (LC-50), is the default choice, which allocates 50 per cent of the investment to equity. Under the auto choice option, guardians can select from three lifecycle funds— aggressive LC-75, moderate LC-50, and conservative LC-25— based on their risk tolerance.

Under the Active Choice option, guardians have full control over how they allocate funds across four asset classes: 75 per cent in equity for higher growth potential, up to 100 per cent in corporate debt for stability, up to 100 per cent in government securities for safety, and up to 5 per cent in alternate assets for diversification.

These options allow guardians to tailor their investment strategies based on their financial goals and risk preferences.

How to be a part?

The scheme enables all minor citizens up to the age of 18 to open an account.

While the account is opened in the name of the minor, it is managed by their guardian until the child reaches adulthood.

The account can be created through registered Points of Presence (PoPs) which include major banks, India Post, and pension funds. Accounts can also be set up online via the NPS Trust's eNPS platform.

What are the documents required?

To open an NPS Vatsalya account, necessary documents include proof of date of birth -- birth certificate, school leaving certificate, matriculation certificate, PAN, or passport; guardian's proof of identity and address, which can include Aadhaar, driving license, passport or Voter ID card.

A Permanent Account Number (PAN) of the guardian or Form 60 declaration, as per Rule 114B is also needed.

In case the guardian is an NRI (Non-Resident Indian) or OCI (Overseas Citizen of India), an NRE/NRO bank account (solo or joint) of the minor will be required.

Transition upon attaining 18 years

When the minor reaches the age of 18, the NPS Vatsalya account will seamlessly transition to the NPS Tier-I (all-citizen) model. A fresh KYC must be completed within three months from the date of turning 18.

Once the account transitions, the features, benefits, and exit norms applicable under the NPS Tier-I all-citizen model will come into effect.

This innovative scheme is expected to enhance financial planning and ensure a dignified future for all citizens, setting a precedent for comprehensive financial well-being across generations.

(With inputs from IANS)