VG Siddhartha's Coffee Day Enterprises was valued at Rs 18,000 crore and profitable for the last three years. It has a footprint of nearly 1,600 stores with 54,000 vending machines and over 500 express stores.

Even though Siddhartha was facing a challenge amid rising competition and a debt of Rs 6,500 crore, the coffee business was doing reasonably well. Although the losses piled up to Rs 395 crore between FY14 and FY16, the next three fiscals registered a profit after tax (PAT) of nearly Rs 185 crore. The year-on-year (YoY) profit rose by 509 percent to Rs 49 crore in FY18. On a quarterly basis, the PAT growth was not steady between FY18 and FY19.

Despite, the profits the coffee empire set up by Siddhartha was on shaky grounds because of the crackdown by the Income Tax department as well as pressure by one of the promoters which led to a liquidity crunch in the company.

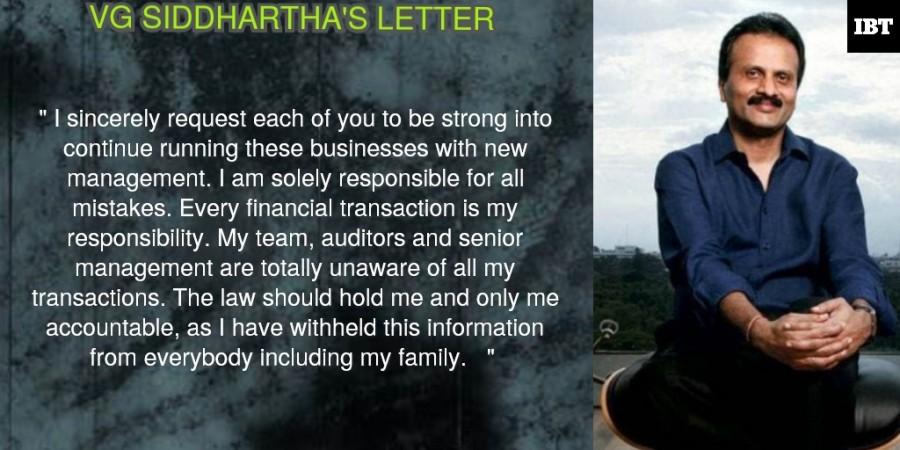

A letter written by the coffee tycoon before committing suicide mentioned that he was facing persistent pressure from one of the private equity partners to buy back the shares. "I fought for a long time but today I have given up as I could not take any more pressure from one of the private equity partners forcing me to buy back shares," he had written in the letter addressed to CCD employees and the partners.

"A transaction I had partially completed six months ago by borrowing a large sum of money from a friend. Tremendous pressure from other lenders led to me succumbing to the situation," he added.

In 2017, the IT department had conducted a series of raids at the offices of Siddhartha in Bengaluru, Mumbai and Chikkamagaluru to seize documents over accusations of undisclosed income of over Rs 650 crore.

In a statement, the IT department said that the accusations also included violation of statures on which there was no income disclosure and the amount undisclosed was estimated to be more than Rs 650 crore.