With shares of Vedanta Limited trading largely flat in a strong stock market on Wednesday, the parent firm Vedanta Resources Limited (VRL) announced plans to delist its metals and mining stock from the Indian stock market. The indicative price for delisting would cost $2.2 billion and the funding will be possible based on potential additional annual dividend income of $500 million.

Intent to delist Vedanta from the bourse: How does it work?

Vedanta owns a significant stake in marquee businesses such as aluminium, oil and zinc (Hindustan Zinc), which generates a lot of cash flow. To delist from the bourse, Vedanta would need the board's approval. A board meeting of Vedanta's independent directors to discuss the plan of action further is scheduled on Monday, May 18.

The company would then require approvals of minority shareholders by way of a special resolution adopted through a postal ballot, at least two times votes should be in favour of the delisting proposal. Further, the company would also need to obtain regulatory approvals in India and the US, given its ADRs.

A final floor price will then be set and a reverse book building process will be initiated. The final exit price will be determined in a way that it would increase promoter shareholding to 90 per cent. The company can then at its discretion accept or reject the final exit price.

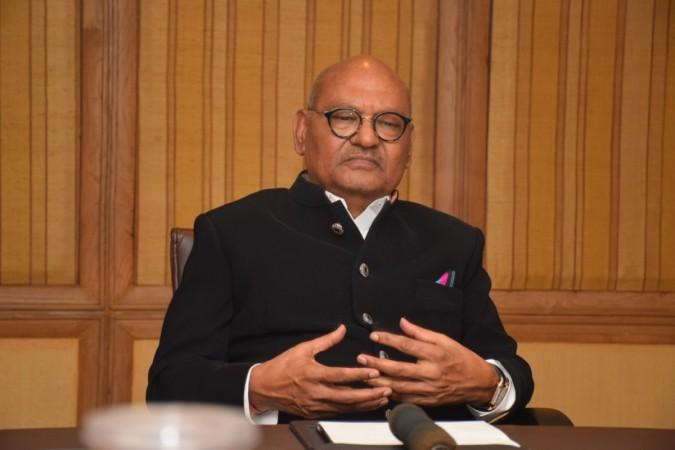

The COVID-19 impact has not spared any industry and the metal business of Vedanta is hugely affected. This reflects in company revenues and earnings for the year. Anil Aggarwal, Chairman and founder of Vedanta Resources Limited (VRL) is looking at delisting from share markets as an opportunity to take the company private, which will provide impetus to growth with more operational and financial flexibility to the company in a capital-intensive business.

The success of delisting would depend on the extent of the gap between the promoters offer and minority expectation. Vedanta has been underperforming in the broader market with a fall in commodity prices, high promoter level debt and overall disappointment in operational performance. In recent times Vedanta's shares have been trading at a discount to the intrinsic value of its resources and assets, or the replacement value.

When delisting happens, the minority expectation could be closer to the replacement value or significantly higher than the recent stock price. The delisting rules in India suggest that if the promoter's holding exceeds 75 per cent in the company, then the stock can be taken off from trading on the exchanges. This means that all the investors of the company, who have been holding shares of Vedanta with high hopes, will have to be satisfied with the final offering since they are not left with any option to choose, reflect and then decide.

The delisting route to end Vedanta's debt woes

According to Motilal Oswal Securities, huge debt at Vedanta's parent company was a growing concern. However, the brokerage maintained its neutral stance on Vedanta with a price target set at Rs 85 per share. The company fixed the indicative price at Rs 87.50, discounting 2 per cent from its Tuesday's closing price of Rs 89.30. On Wednesday, May 13, Vedanta's shares traded at Rs 90.50 on BSE as of 11 pm (IST), up by 1.34 per cent, a news report stated.

In 2018, the promoters had delisted VRL from the London Stock Exchange considering the company has nearly $7 billion in debt, of which $1.9 billion is maturing in the next 12-15 months according to brokerages. Dating back in time, Vedanta Resources was the first Indian company to be listed on London Stock Exchange in 2003 in a $644 million offer.

As a matter of fact, considering the minority ownership holds a 50 per cent stake in Vedanta and 35 per cent minority holding in Hindustan Zinc, the upstreaming of funds via dividends has multiple leakages from the promoter's perspective. Vedanta is only an operating entity for the company, dependent on the subsidiary's dividends to fund interest obligations.

In a stock exchange filing, the promoter group Vedanta Resources (VRL) expressed its intention to, either individually or along with one or more subsidiaries, acquire all fully paid-up equity shares of the company in the delisting offer at a price of Rs 87.5 per equity share, according to a news report. This represents a premium of 9.9 per cent over the closing market price of Rs 79.6 as on May 11, 2020, on BSE and NSE.

If the delisting is carried out using a reverse book building process, the shareholders get an opportunity to tender their shares at the indicative price or more and the promoter shareholding, in this case, has to cross 90 per cent. The delisting offer can also be withdrawn if the discovered price is not acceptable.

A bid to make Vedanta Limited private failed because the stock closed just 1 per cent higher at an indicative price of Rs 87.50, lower than its last closing price of Rs 90.2. Experts are of the opinion that indicative pricing should be significantly raised and the delisting price will have to be much higher, given the past trend.

Should Vedanta Ltd. reconsider its decision to delist once again?

Announcing the fourth tranche of the economic relief package for industries, Finance Minister Nirmala Sitharaman issued reforms in the commercial mining policy, to put an end to government monopoly in the coal mining sector. She said, "Commercial mining will be done on a revenue-sharing mechanism instead of the regime of fixed rupee/ per tonne."

Nearly 50 blocks will be offered for bidding and this move will help increase self-reliance in coal production and reduce import of substitutable coal. With no eligibility of condition is required to be a bidder, but only an upfront payment with a ceiling. The removal of monopoly in coal mining would mean any party can bid for coal blocks and sell in the open market. This new reform introduced is in stark contrast to the earlier norms that require only captive consumers with end-use ownership to be able to bid.

Also, the distinction between captive and non-captive mines has been removed in today's announcement. This will facilitate the transfer of mining leases and sale of surplus unused minerals with a rationalisation of stamp duty payable at the time of awarding of mining leases, a news report confirmed. In a move to cut electricity costs for the aluminium industry, a joint auction of bauxite and coal mineral blocks will be introduced. Nearly 500 mining blocks will be offered through an open and transparent auction process.

Further, the government will invest Rs 50,000 crore for creating evacuation infrastructure for coal. Encouragement will be provided for coal bed methane (CBM) production and coal gasification and liquefaction will be incentivised through rebate in revenue sharing. With India being blessed with an abundance of coal, bauxite and mineral resources, amendments made to the commercial mining policy and removal of monopoly will bolster India's production of these critical key resources.

"Despite sufficient domestic aluminium capacity, currently 60% of India's consumption is imported, resulting in Forex outgo of $5.5bn (Rs 38,000 crore), says Ajay Kapur, CEO of Aluminium and Power business, Vedanta Limited. "The domestic industry is capable of catering to the country's domestic demand by increasing production from 2 mtpa to 4.1 mtpa, thus mitigating the need for imports. Our assessment is that if these reforms are implemented at the earliest, it will double the sector's contribution to the GDP."

Delisting of Vedanta could mean shareholders may rue potential opportunity loss, considering the stock is undervalued. Prodding deeper, the company could be a major gainer from this latest announcement by FM Sitharaman on seminal reforms in coal and mining today. Imagine valuation upside, once these reforms are implemented.

What will be the views of Vedanta's independent Directors and shareholders on the delisting decision, post this huge opportunity presented by the Centre's announcement to reform the coal and mining sector? We have to wait and watch what happens on Monday, May 18 in the board meeting of Vedanta Limited. Stay tuned with us for news updates on this story further.