Consumer prices in the United States increased 6.8% in November compared to the previous period a year ago, as rising costs for food, energy, housing, and other commodities resulted in the steepest annual inflation rate since 1982. The Labor Department also announced on Friday that prices increased by 0.8 percent from October to November.

Consumers, particularly lower-income households, have been feeling the brunt of inflation, especially when it comes to basic necessities. It has also overshadowed many employees' increasing pay, hindered the Federal Reserve's efforts to remove economic stimulus, and coincided with dwindling popular support for US President Joe Biden. A combination of variables arising from the rapid recovery from the pandemic slump has fueled inflation: Government stimulus, Fed-engineered ultra-low rates, and factory supply shortages in the United States and elsewhere. Heavy-than-expected customer demand, COVID-related shutdowns, and overburdened ports and freight yards have all hampered manufacturers.

Employers in the US have been rising compensation in response to labour shortages, and many have increased pricing to offset higher labour expenses, contributing to inflation. As a result, prices for everything from groceries to secondhand automobiles to gadgets, home furnishings, and rental cars have risen. The rise in pricing, which began when the virus struck and Americans trapped at home swamped companies with orders for commodities, has now moved to services ranging from apartment rents and restaurant meals to medical care and entertainment.

Impact on India

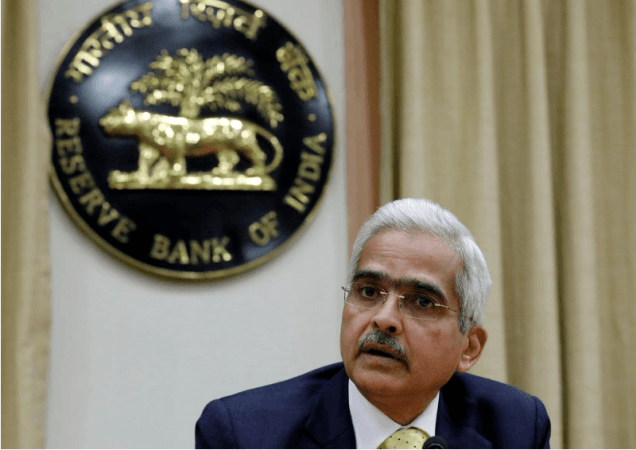

When global prices rise, imported inflation rises as well, causing our current account imbalance to grow even more. Inflationary pressures in industrialized economies, particularly the United States, are likely to push central banks to abandon their loose monetary policies. Higher interest rates would result from the Fed's and other central banks' tight monetary policies. This will have a two-fold impact on the Indian economy: first, it will be more expensive for Indian companies to raise funds outside of India. Furthermore, the Reserve Bank of India will have to align its monetary policy domestically by boosting interest rates.