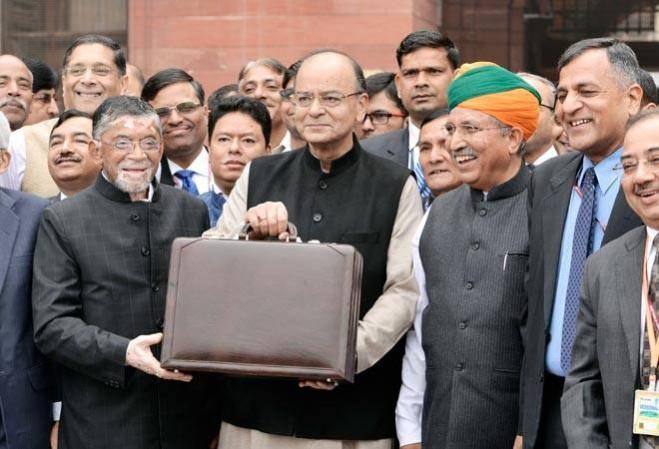

Finance minister Arun Jaitley's Union Budget 2017 has received mixed reviews from Rajdeep Sardesai, Barkha Dutt, Shekhar Gupta, Rahul Kanwal and other leading journalists.

The journalists are impressed with a new policy on election donations. They say that this move will bring transparency in political funding. The infrastructure status to affordable housing is another highlight of the Union Budget 2017, which is expected to benefit poor, downtrodden, villagers and farmers in a big way.

But these journos feel that the Govt does not have clear road map for certain aspects and this may not yield expected results. However, Rajdeep Sardesai, Barkha Dutt, Shekhar Gupta, Rahul Kanwal and others shared their views. Continue to read Union Budget 2017 review:

Rajdeep Sardesai, Consulting Editor at India Today group

Credit to Modi govt for putting railways as part of a union budget.. Now to get railways back on track #ModiNomics17

New law for confiscating assets of those wanted who are abroad. But enough laws already exist: just act on them! #ModiNomics17

Jaitley says: Will stick to policy of fiscal prudence.. Pegged fiscal deficit to 3.2 per cent of GDP! #ModiNomics2017

Income tax for small companies below RS 50 crores reduced by 5 per cent to 25 per cent: #ModiNomics17

Election donor bonds seems a good idea. But will political parties file accurate tax returns? They don't at the moment.. #Budget2017

Highest ever allocation for MNREGA. To think in 2014 election battle, MNREGA was seen as a white elephant by then oppn! #Budget2017

Positive: affordable housing, MSMEs get tax breaks, negative: lack of clarity on DeMo impact, no big idea to kickstart growth #Budget2017

Positive: fiscal prudence; boost to infra spending; no major blooper; negative: one more surcharge, no road map for banks #Budget2017

Big industry not happy: Wanted a corporate tax cut. But where is incentive for honest, tax compliant citizens like you and me? #Budget2017

Would love to support govt's election funding initiative. But fear it's a 'chuha' to tackle a mountain of corruption. #Budget2017

Positive word for budget: stable, cautiously optimistic; negative: unimaginative, too conservative. Think that's fair? #Budget2017

Headline for morning papers: Finance minister bets big on small (small farmer, SMEs and poor) #Budget2017

Barkha Dutt, Former Consulting Editor at NDTV

Infra status for low cost housing. Push to real estate post Notebandi. #Budget2017

FIPB abolished. Big announcement #Budget2017

New law to confiscate assets of economic offenders abroad. Though Will is more critical than more Laws #Budget2017

Wow. These bank deposits post Demonetisation is really revealing. 1.09 crore accounts saw deposits between two lakhs and 80 lakhs #Budget

Huge announcement. Cash donations to political parties from any one source down to two thousand from twenty thousand #Budget2017

Swacch Politics now ? Electoral bonds to be introduced that can be bought by donors says @arunjaitley . Very significant #Budget2017

Shekhar Gupta Founder of The Print

Limiting cash to Rs 2k for political parties is revolutionary reform, as are election bonds. Can greatly clean up politics #Budget2017

Reducing duration of assessment period for tax scrutinises is and important reform. Can reduce harassment of honest taxpayers #Budget2017

Clear from #Budget2017 that there's no windfall gain at all from #demonetisation RBI can now be honest & give out old-note deposit figures

A +ve in #Budget2017 is keeping fiscal deficit low despite tax/borrow-&-spend temptations. Should help keep inflation & interest rates low

For poor, downtrodden, villagers & farmers, #Budget2017 does in much greater measure what any earlier budget has done: provide lip service

Notice how corporates are lining up to give #Budget2017 8-9 out of 10. Hope this year somebody would make history by giving it 11 out of 10

Rahul Kanwal, Managing Editor of India Today

Abolishing FIPB -- Foreign Investment Promotion Board -- is a positive move. Fewer the Sarkari permissions required the better #ModiNomics17

His initial budget speeches lacked structure. With practise, @arunjaitley has been able to add clear structure & for to his budget speech.

New law to confiscate assets of those who flee the country -- likes of Lalit Modi & Vijay Mallaya beware. Strong move by @arunjaitley

Much needed. 500 railway stations will be made differently-abled friendly by providing lifts and escalators: #Budget2017 #ModiNomics17

Personal Income Tax. Move to reduce burden of tax burden on salaried class. Tax rate between 2.5 to 5 lakhs brought down to 5%. Tax halved.

All tax payers who earn more then Rs 5 lakhs will get a relief of Rs 12,500. What a strange formulation. Should have gone whole hog!

Smart move. No point in tinkering with excise and service tax rates since GST is on the way. #ModiNomics17

MK Venu, Founding Editor of The Wire

Jaitley says effects of demont not to spill over to next year. CEA said significant risks remain for next year. Should I be confused?

High demand for work under Mnrega post demonetisation leads to higher allocation of Rs.48000 cr. Even this may be less given work demand.

Infrastructure status for low cost housing. This could get such specific infrastructure investments 10 year tax holiday.

Jaitley finishes rail budget related announcements in 3 minutes. Dont have to explain why operating ratio has massively shot up to 108 !

Rs 10,000 cr allocated for bank recapitalisation. Peanuts considering Rs 3 lakh crore needed by PSU banks which remain stressed by NPAs.

New law to confiscate domestic assets of economic offenders fleeing the country. Question is if it will be retrospective covering Mallya/Modi

Jaitley says political parties cant receive more than Rs 2000 in cash from a donor. Will donor name be disclosed? That is the key.

No direct one time money transfer to the poor and farmers as was being anticipated post demont.

Overall expenditure growth barely 10% With this no dramatic increase in welfare is possible in backdrop of demont. Business as usual.

Capital investment in irrigation infra remains very low. PM' s flagship programme of "Har Khet Ko Pani" difficult to achieve at this rate.

Social sectors continue to be underfunded overall. Govt under pressure to maintain fiscal deficit targets to impress global finance capital.

Individuals with annual taxable income of Rs 50 lakh to Rs1 crore will end up paying about 35% after the surcharge and various cesses.

Farmers and the informal sector workers hit by demont havent got anything substantive from the budget.

Next big reform should be making Central Budget as irrelevant as that of railways! Most policy change happens outside budget.

Sucheta Dalal Managing Editor Moneylife

A much more crisply written and delivered budget speech so far!! :-) Good .Hope content as good on key issues @arunjaitley

This is half a budget. Some things were announced on 31st Dec & many others will come to us in different forms during the year!! GST etc

Finally some move towards transparency in political funding. Much needed. Representation of People's Act to be amended. From 20k to Rs 2k

How does this really help? Earlier Netas fudged bills of less then Rs 20000. Now they will make more fake bills of smaller denomination!

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive] 'Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=135&l=50&t=40)

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=135)

![Nayanthara and Dhanush ignore each other as they attend wedding amid feud over Nayanthara's Netflix documentary row [Watch]](https://data1.ibtimes.co.in/en/full/806599/nayanthara-dhanush-ignore-each-other-they-attend-wedding-amid-feud-over-nayantharas-netflix.jpg?w=220&h=135)