The second half of the financial year 2016-17 was a highly eventful one for the Indian economy that witnessed the biggest disruption in the form of demonetisation of high-denomination currency notes on November 8 last year followed by its consequences on various sectors.

While those like the aviation sector remained unscathed and banks saw a surge in deposits, many sectors took a hit, such as automobile, manufacturing and services, before witnessing a rebound in March.

Trends in various segments

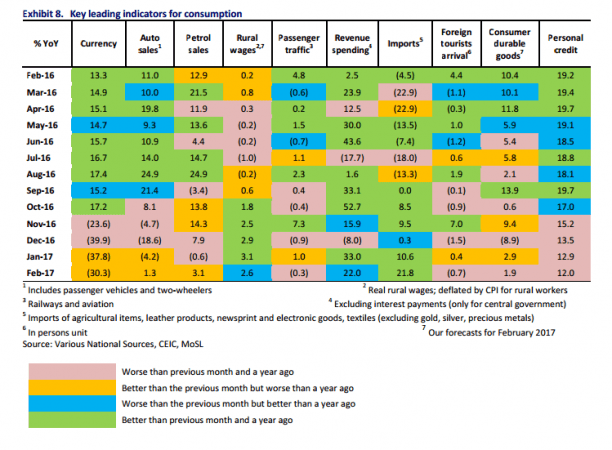

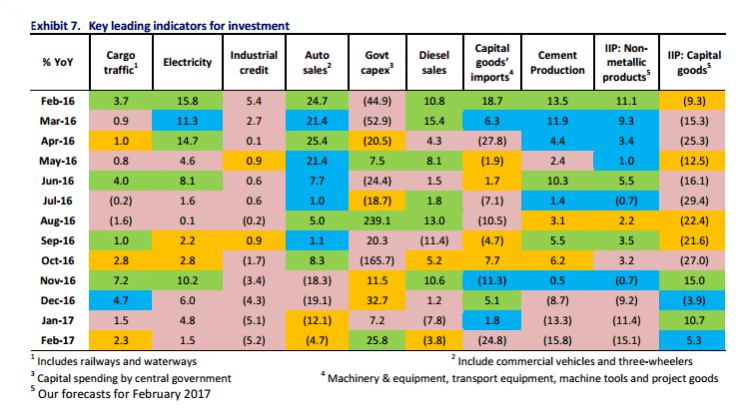

In an interesting analysis that spans just two charts, brokerage Motilal Oswal Securities Ltd. (MOSL) has captured the trends witnessed in various segments of the Indian economy, which is Asia's third-largest.

The four colours used in the charts show the trends in indicators as vast as cargo movement, fuel sales, aviation, imports, loans (industrial and personal), among others.

A key takeaway is the disappointing trend in industrial credit from an investment perspective and a weak trend in consumption of consumer durables; while most other indicators represent a mixed trend. The partial implementation of the 7th Central Pay Commission (CPC) by the Narendra Modi government and some other state governments apparently did not give the boost to the economy as expected.

The year also saw the Indian government discarding a more-than-92-year-old practice of presenting a separate budget for Indian Railways by merging it with the Union Budget. Yet another deviation was the presentation of the Budget on the first day of February as against the earlier practice of February end.

The government's estimates for FY2017 have suggested that the Indian economy would end up with 7.1 per cent GDP growth rate, enabling the country to retain the "world's fastest-growing economy" tag even as its neighbour China scales down its projections.

Another feature of FY2017 has been the sharp recovery in the domestic currency that ended as the third best-performing Asian currency in the March quarter, aided by massive inflows into the debt and equity markets by foreign institutional investors.