![[Representational image] usd vs inr, indian rupee vs us dollar, implications of rising rupee, rupee at record high, rupee volatility, impact of rupee on exports](https://data1.ibtimes.co.in/en/full/632881/rs-500-notes.jpg?h=450&l=50&t=40)

The Indian rupee (INR) reversed its winning streak on Tuesday, opening marginally lower at 65.39 from the previous day's close of 65.36 against the US dollar (USD). The currency has been rising in tandem with the foreign investor-driven rally on stock markets ever since the BJP's victory in Uttar Pradesh elections on March 11. Strong macroeconomic fundamentals, coupled with the electoral results, have enabled it to appreciate 3.8 percent since January 1 this year.

However, will the bull run of the domestic currency be sustainable and what does it mean for the Indian economy?

Teresa John, research analyst at brokerage Nirmal Bang Institutional Equities (NBIE) answers this and many related questions in her research report, in addition to estimating the exchange rate range for FY2018 and FY2019.

1. Rupee is more sensitive to the US dollar....

"A basic analysis indicates that the correlation between portfolio flows and USD-INR increased to 0.59 for the period after the taper tantrum in July 2013, compared with a long-run average of 0.37, and 0.18 in the period immediately after the global financial crisis when the US resorted to quantitative easing. This leads us to believe that movements in the INR are increasingly becoming more sensitive to foreign portfolio flows."

...and has its upside

"The rising sensitivity to capital flows indicates that the exchange rate is, for the most part, market-determined, thereby minimising the moral hazard of market participants relying on policymakers to bail them out in times of extreme adverse movements in the currency."

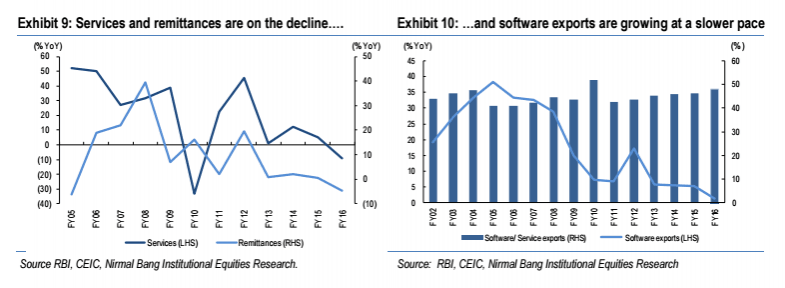

2. Lower support from remittances, services exports

"Services exports and remittances have been affected by vagaries of economic cycles in the past and have exhibited sharp swings in line with global growth. Since FY12, both services and remittances have both witnessed a secular decline. Also, the Indian IT industry, which is primarily responsible for the services surplus, is expected to grow at a much slower pace than in the past."

"The Gulf countries account for nearly 50 percent of the remittances to India, and therefore a recovery in crude oil prices may to some extent help in stabilising remittances, but with limited migration opportunities, headwinds for the IT industry and second-generation migrants less likely to send money back to India, it is difficult to envisage a sharp upturn in remittances."

3. Rising current account deficit to stem rupee's gains

"The current account deficit (CAD) has been declining since FY13 and is estimated to be less than 1 percent in FY17. However, we expect the CAD to rise to 1.9 percent in FY18 as growth recovers, and it is likely to sustain at around 1.5-2 percent level in the coming years. Exports are recovering after over two years of decline, but this has been offset by a similar rise in imports."

"Moreover apart from domestic demand, the import intensity of India's key exports like gems and jewellery, mineral oil and chemicals is high."

"Besides India's CAD is sensitive to commodity prices, particularly of crude oil and gold, and therefore the deficit could possibly be higher should global commodity prices rise, similar to the decline in the CAD in recent years which was supported partially by the fall in global commodity prices."

Forecast

The analyst expects the rupee-dollar exchange rate to be around 68.5 in the next financial year and 70 in FY2019, marking a slight improvement from the earlier estimate of 70 for FY2018 and 72 for FY2019, "although intermittent swings are expected."