Tech Mahindra was the top gainer on the Bombay Stock Exchange (BSE) on Tuesday morning in response to its better-than-estimated June quarter (Q1) performance. The stock hit an intraday high of Rs 413.90 and was trading 6.29 percent higher at Rs 409.50 at around 10.25 am, outperforming the benchmark index Sensex that was up 42 points (0.13 percent) at 32,557.

Stocks leading the modest Sensex rally included Wipro and Hindustan Unilever. Stocks that hit a fresh 52-week high during the day included Wipro, Hindalco, TVS Motor and Tata Steel.

Also read: Tech Mahindra trades flat ahead of June quarter results

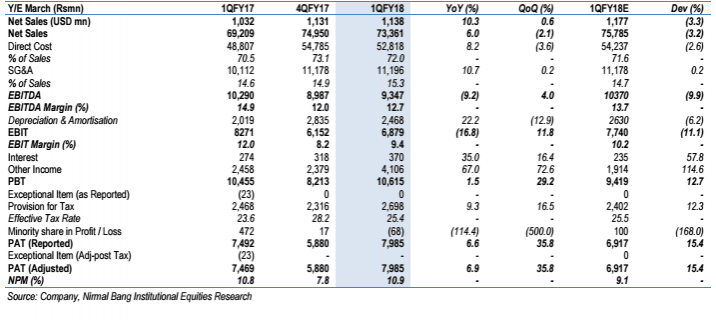

On Monday, Tech Mahindra reported 10.27 percent rise in revenues to $1,138 million for Q1 in comparison to $1,032 million in the corresponding period last year. Net profit came at Rs 798.5 crore, up 6.6 percent from Rs 749.2 crore in the year-ago period.

The restructuring of Lightbridge Communications Corporation (LCC) acquired for about $240 million in November 2014 is poised to boost revenues from communications vertical, IDBI Capital & Markets said on Tuesday.

"With the restructuring of LCC business being completed, Tech Mahindra expects the communications vertical (45.2 percent of revenues) to come back on the growth path. We expect this coupled with growth in the Enterprise business to result in a pick-up in growth from Q2FY18 onwards. In Q1FY18, the company secured large deals worth $325 million, maintaining the quarterly run-rate of FY17.," the brokerage said in its note.

It upgraded the stock price to Rs 448, marking a significant upside from the current levels.

On the contrary, brokerage Nirmal Bang Institutional Equities (NBIE) downgraded the share price to Rs 360, citing the 2 percent decline in constant currency terms.

"Tech Mahindra highlighted that it will face an additional headwind of 30bps-40bps from wage hike in 2QFY18, but indicated levers for margin improvement in FY18 such as (1) Absence of one-time restructuring costs. (2) Increase in employee utilisation and pyramid. (3) Use of automation. (4) Pruning of unprofitable clients. (5) Revival of Comviva," the brokerage said, but added that the optimism could be misplaced to a great extent.

In other business news, the Reserve Bank of India's monetary policy committee (MPC) commences its two-day meeting today amid hopes of a 25 basis points cut in repo rate from the current 6.25 percent in view of retail inflation hitting a new low of 1.54 percent for June, much below the RBI's target level of ~ 4 percent. A fall in the rate is widely seen as a signal for banks to reduce lending rates, thereby boosting the economy, though there is little evidence to prove it.

The outcome of the MPC meeting will be announced tomorrow (August 2).