Tata Motors reported a huge dip in its consolidated net profit for the third quarter (Q3) on Tuesday, resulting in its share price crashing almost 10 percent on Wednesday. The stock hit an intraday low of Rs 441 before recovering to trade 7.70 percent lower at Rs 450 on the BSE at around 10.15 am even as a brokerage warned of sustained weakness for a longer duration.

Read: Confused on what is TAMO? All you need to know about Tata Motors new sub-brand

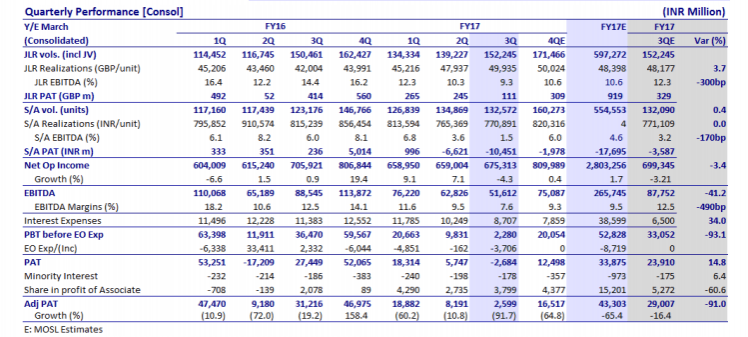

The company's consolidated net profit for the third quarter had fallen 96 percent to Rs 112 crore as against Rs 2,953 crore in the corresponding period last financial year. Consolidated revenues also dropped 4.3 percent YoY to Rs 67,484 crore in comparison to Rs 70,567 crore in the year-ago period.

Its overseas business, Jaguar Land Rover (JLR) were hit by operational weakness and huge foreign exchange losses, according to the company.

"The operating performance in the quarter reflects lower wholesale volumes and less favourable product mix partially offset by favourable market mix (including the runout of Discovery); unfavourable variable marketing expense including the extended 16MY runout expenses in the US; higher new model launch costs and Biennial pay negotiation settlement and unfavourable unrealized FX and commodity hedge revaluation as well as USD debt revaluation," Tata Motors said in a regulatory filing.

Weakness to persist, says Motilal Oswal Securities

In a note, brokerage Motilal Oswal Securities Ltd. (MOSL) said the company's foreign exchange losses would continue for another nine to 12 months. "Fx hedge losses would remain at similar levels (assuming stable GBP) for next 3-4 quarters. As a result, near term EBITDA margins are expected to be 10-11 percent, though management guided for sustainable margins at 14-15 percent," MOSL analysts said.

Brexit, Trump and Tata Motors

Slashing its earnings per share (EPS) for Tata Motors, the brokerage said the double whammy of weak domestic commercial vehicle sales and political uncertainty in Britain triggered by Brexit need to be watched out for, besides developments in the US.

"In near term, two political events pose risk to our estimates, further GBP (Great Britain Pound) depreciation if Article 50 is triggered resulting in formalizing Brexit, and further development on import taxes in US." The reference is to protectionist policies being contemplated by the Trump administration that implies encouragement to domestic production and tariff barriers on goods produced outside the country.