The UK's car manufacturing and exports touched multi-year highs in 2016, while exports to India increased by 15.8 percent last year, riding largely on demand from Tata Motors-owned Jaguar Land Rover (JLR) models.

Indian luxury car market likely to post its first ever decline in 2016

UK car exports to India reached at 3,372 in 2016 as an increasing number of affluent Indian buyers took advantage of a range of new premium and luxury British-built cars, the Society of Motor Manufacturers & Traders (SMMT), one of the UK's largest trade associations, said on Thursday.

At the same time, India emerged as the eighth largest Asian market for UK car exports with JLR's Land Rover Discovery Sport, Ranger Rover Evoque, Jaguar XF, Jaguar XE and Jaguar F-Pace among the top five most popular models.

Additionally, 31,535 new cars were registered in the UK last year by Indian-built car models, up 12.6 percent over 2015.

Mike Hawes, SMMT chief executive, said: "India and the UK have a great history of collaboration in the automotive sector and it is essential we secure mutually beneficial trade relationships in the future. India is a growing market, for the moment largely for luxury vehicles. But we face high import tariffs which make it more difficult to sell into India."

He added it remains to be seen the kind of trade deal the UK may look to agree with India post-Brexit.

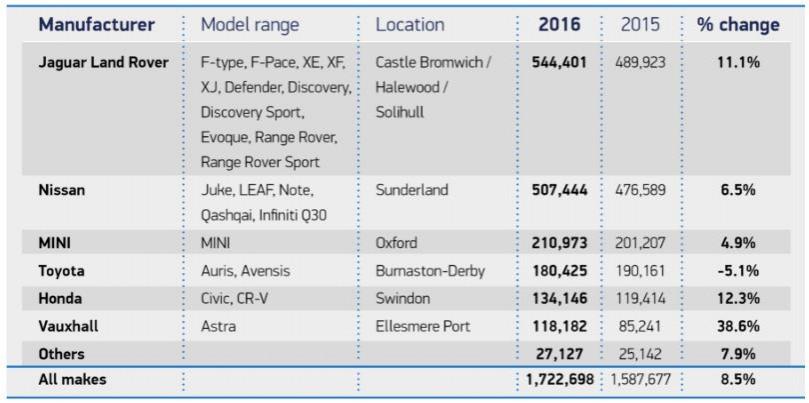

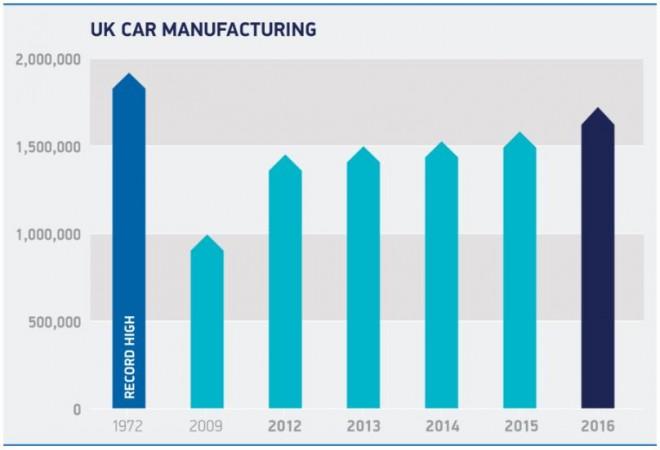

Meanwhile, British car manufacturing hit a 17-year high as about 1.7 million vehicles from some 15 manufacturers rolled off production lines in the country in 2016, up about 8.8 percent from approximately 1.6 million total car manufactured in 2015. JLR cars accounted for almost 32 percent of the all the cars manufactured in Britain in 2016. The Tata Motors' subsidiary rolled out 544,401 cars in 2016, up 11.1 percent from 489,923 cars it produced in 2015.

Also, more cars are now being exported from Britain than ever before. As many as 10 new car models started production in the UK last year, nine of them from premium brands which helped the UK become the second biggest producer of premium cars after Germany and the third biggest car producer in Europe.

However, total committed investment announcements in the automotive sector in 2016 were down to £1.66 billion from £2.5 billion in 2015 across a number of companies. The rise in production was mainly driven by overseas demand, with the global appetite for British-built cars rising by 10.3 percent to an all-time high of 1,354,216 cars in 2016. Around eight out of every 10 cars manufactured in the UK is now exported.

Exports to the rest of the EU accounted for more than half of all UK car exports and grew 7.5 percent to 758,680 units. Exports to the US – the UK's biggest export destination after the EU – rose by 47.2% percent, while uplifts were also seen exports to Turkey, Japan and Canada. China, third on the list of UK's export markets, grew by 3.1 percent with 88,610 vehicles exported last year.

Domestic demand for UK-built cars grew by mere 2.4 percent in 2016.

![India Auto Roundup: Maruti Suzuki, Mahindra have exciting launches in November [details here]](https://data1.ibtimes.co.in/en/full/805520/india-auto-roundup-maruti-suzuki-mahindra-have-exciting-launches-november-details-here.jpg?w=220&h=135)