The State Bank of India (SBI) became the first public sector lender to join the three private banks — HDFC Bank, ICICI Bank and Axis Bank — in issuing new norms for cash transactions. Besides, the SBI also re-introduced penalty on non-maintenance of minimum cash balance in accounts, effective from April 1, 2017.

Deposits

Savings-account holders can now deposit cash thrice in a month free of cost; any further cash transaction will attract Rs 50 penalty and service tax. In case of current acounts, the penalty could go up to Rs 20,000, according to a PTI report.

Withdrawals

a. From SBI ATMs

While five withdrawals are free in a month; from sixth onwards, the bank will charge Rs 10 per transaction. If the balance in the account does not fall below Rs 25,000, the bank won't impose any charge.

b. From other ATMs

If SBI account-holders withdraw cash from other bank ATMs, the first three transactions in a month will be free. From the fourth onwards, the bank will charge Rs 20 per withdrawal. If the balance is maintained above Rs 1 lakh, the bank won't charge any amount for cash withdrawal.

SMS alerts

Debit-card holders who maintain an average quarterly balance of up to Rs 25,000 will be charged Rs 15 for SMS alerts per quarter.

Minimum balance and charges thereof

Account holders will henceforth have to maintain a monthly average balance (MAB), failing which they will have to pay penalty of up to Rs 100 and service tax thereof.

"In metropolitan areas, there will be a charge of Rs 100 plus service tax; if the balance falls below 75 per cent of the MAB of Rs 5,000. If the shortfall is 50 per cent or less of the MAB, then the bank will charge Rs. 50 plus service tax," the PTI quoted from a bank official release.

The charges would depend on the location of the branch. The new rules will be effective from April 1, 2017.

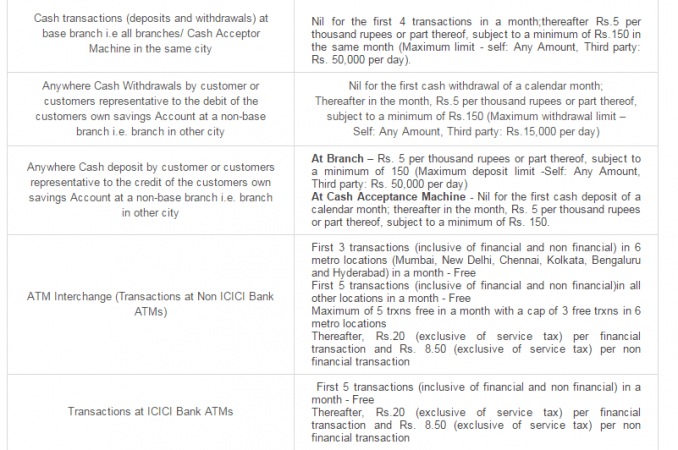

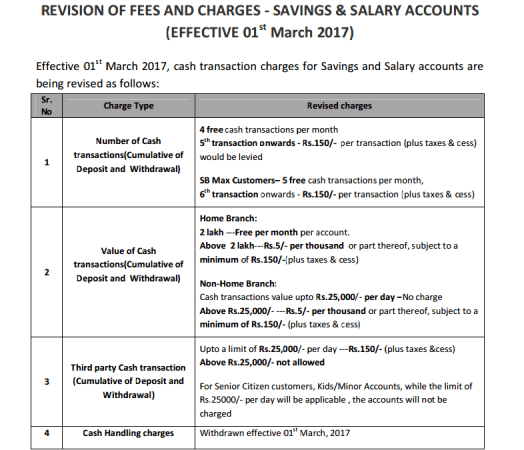

Earlier, the three private lenders — ICICI Bank, HDFC Bank and Axis Bank had come out with new restrictions on cash deposits and withdrawals, effective from March 1, 2017.

HDFC Bank

ICICI Bank

Savings Account