State Bank of India (SBI) has slashed interest rates on home loans effective from January 1, 2017, after reducing the marginal cost of lending rate (MCLR) by a steep 90 basis points to 8 percent. The decision follows deposit surge after demonetisation, making the cost of funds cheaper for banks.

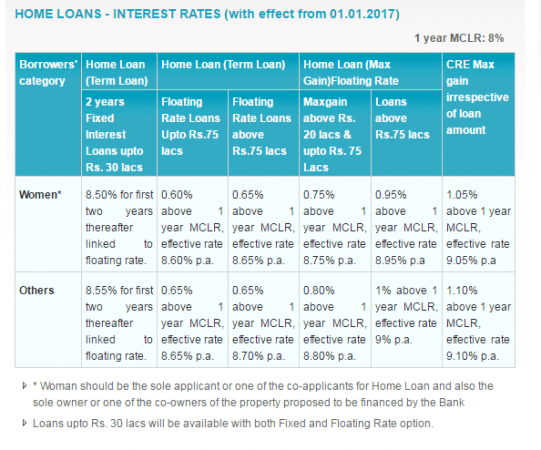

The reduction in home loans varies for gender (lower for women) and amount. Home loans are linked to one-year MCLR and therefore new home loan borrowers can be assured of the rate for at least 12 months.

Read: Realty stocks slide over possible crackdown on illegal properties

Women

In the floating rate category, the interest rate for loans up to Rs 75 lakh is 8.60 percent per annum, while for loans above that limit, it will be 8.65 percent.

Others

In the floating rate category, the interest rate for loans up to Rs 75 lakh is 8.65 percent per annum, while for loans above that limit, it will be 8.70 percent.

The rates go up for both categories of borrowers under the bank's Home Loan (Max Gain) Floating Rate option.

Other lenders, both in the private and the public sector, are expected to announce similar reduction given the changed dynamics of deposit-credit triggered by demonetisation in November last year.

"We are flush with funds and credit offtake is nil. The expectation is that it will help us in increasing the loan portfolio because, otherwise, a lot of money is going into treasuries, low-yielding instruments. As a result, if the credit offtake improves, the impact will be neutralised," Rajnish Kumar, managing director, SBI, told BloombergQuint.

The fall in lending rates is more than what was expected, according to brokerage house Motilal Oswal Securities Ltd. "PSU Banks like SBI and PNB announced a cut in lending rates. Overall interest rates were expected to move lower but the cuts seem sharper than expected," it said in a note on Monday.

Interest subvention announced by PM Modi

In his address to the nation on December 31, 2016, after the end of the 50-day deadline for returning the banned denominations (relaxed for certain categories), Prime Minister Narendra Modi had announced interest subvention for home loan borrowers to spur affordable housing.

"Two new middle income categories have been created under the Pradhan Mantri Awaas Yojana in urban areas. Loans of up to 9 lakh rupees taken in 2017, will receive interest subvention of 4 per cent. Loans of up to 12 lakh rupees taken in 2017, will receive interest subvention of 3 per cent.

"In addition to this, another scheme is being put in place for the neo middle and middle class in rural areas. Loans of up to 2 lakh rupees taken in 2017, for new housing, or extension of housing in rural areas, will receive an interest subvention of 3 per cent," he declared.

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)