Shree Cement, Ramco Cement and Dalmia Cement are Motilal Oswal Securities Ltd.'s (MOSL) top picks in the cement sector, one of the victims of Prime Minister Narendra Modi's demonetisation decision.

Read: ATM cash withdrawal limit raised to Rs 4,500 per day; weekly cap unchanged at Rs 24,000

The commodity, largely used by construction industry in addition to infrastructure, has been affected because real estate developers are witnessing a fall in activity due to the cash crunch.

"The key segments of the economy where cash transactions play a vital role are real estate/construction, gold and the informal sectors. The role of cash transaction in case of real estate and gold is mostly dubious," India Ratings had said in a note on November 11 this year.

The sector's woes got bigger due to weak demand and capacity addition, impacting pricing capacity for many companies. Brokerage house Nirmal Bang Institutional Equities had earlier cut the sector's growth rate projections for the current fiscal and 2017-18.

"The demonetisation move by Indian government coupled with other policy measures are likely to impact the two pillars of cement demand in the country the most - housing and infrastructure. We believe the weakness in demand is likely to be spread over the long run compared to the current understanding of it being a short-term phenomenon," it said.

"We expect demand disruption to push down cement demand recovery by at least a year and hence capacity utilisation will be lower for a longer period than what was expected earlier," the Nirmal Bang note added.

On Friday, Dalmia Bharat closed 1.02 percent higher at Rs 1,355, Shree Cement was up 6.66 percent at Rs 14,724 and Ramco Cements ended 1.59 percent higher at Rs 546.

India is the second-largest producer of cement in the world, after China.

Here are the highlights of the MOSL cement sector report:

Large cap cement stocks have corrected by 14-36 percent since the announcement of demonetization on November 8, 2016. These stocks have underperformed the Nifty by 8-30 percent since then due to uncertainty over near-term cement demand.

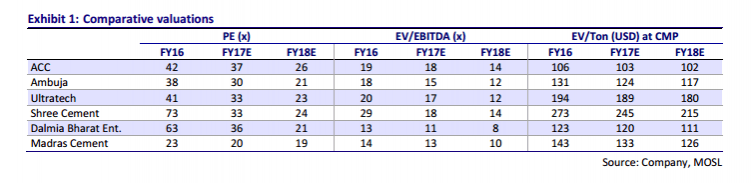

On an EV/ton basis, valuations have moderated partly. ACC is trading at a discount to replacement cost, while Ambuja, Dalmia and Ramco Cement are trading at par with replacement cost.

UltraTech and Shree Cement continue to trade at 28-40 percent premium to replacement cost; however, the premium is lower than earlier.

Current stock prices discount 4-14 percent increase in average FY18 realizations across large cap cement stocks. We believe the ask rate of 4-14 percent increase in realizations is quite steep v/s average realization improvement of 1 percent over FY13-16.

We prefer stocks with strong free cash generation and earnings visibility, coupled with strong return ratio improvement. Our top picks are Shree Cement, Ramco Cement and Dalmia Cement.

We prefer Shree Cement due to superior return ratios – RoCE of 30 percent, with 38 percent EBITDA CAGR over FY16-18E.

Ramco Cement is likely to generate free annual cash flows of INR7b-8b, given strong profitability; it generates a yield of 6-7 percent.

Dalmia Cement trades at an attractive EV/EBITDA of 8x FY18E, given strong earnings growth on sustenance of profitability and lower interest cost.