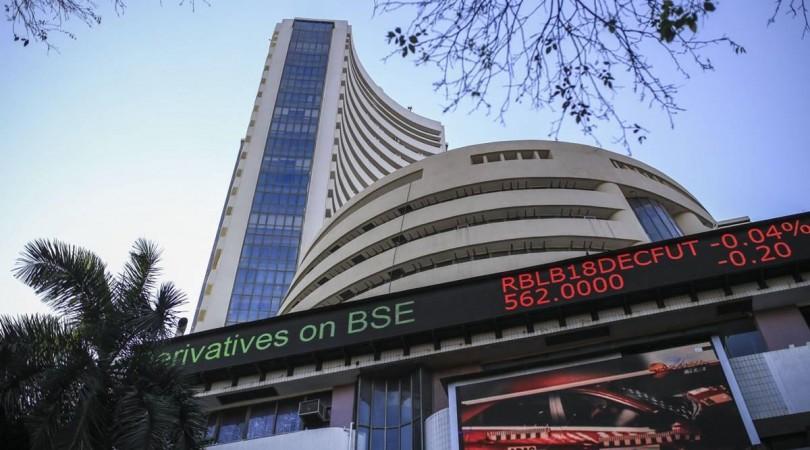

The BSE Sensex on Thursday climbed 743.95 points or 1.03 per cent to 72,845.64 in early trade.

NTPC, IndusInd Bank are top gainers - up by 3 per cent.

The uncertainty regarding the Fed decision is over with the Fed keeping the rates unchanged and refraining from a hawkish message, says V. K. Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

The Fed chief's statement that "inflation has eased substantially while the labour market has remained strong" conveys conviction about the soft landing of the US economy and the possibility of probably three rate cuts this year, he said.

The response from the market was the US indices racing to record highs. This favourable global construct will have its positive impact on Indian markets too, he said.

The tug of war between Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) is being won by the DIIs for sometime now. This trend will continue if the FIIs continue to sell, and, therefore, FIIs are likely to slow down their selling and may turn buyers. This will be positive for largecaps in banking, telecom, capital goods and automobiles, he said.

Deepak Jasani, Head of Retail Research, HDFC Securities said Asian shares bounced while gold prices and Japan's Nikkei jumped to record highs on Thursday after the US Federal Reserve indicated it would stick with plans for cutting interest rates. Equity investors cheered the Fed did not dial back the number of rate cuts that it projects.

(With inputs from IANS)