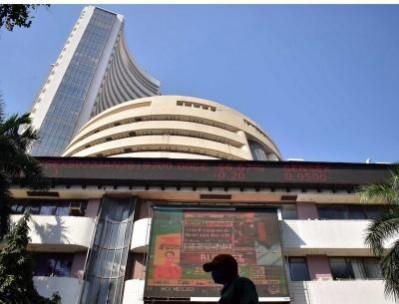

BSE Sensex gained more than 300 points on Monday as geopolitical tensions eased and crude oil prices declined. Sensex was trading at 73,446 points, up by 357 points. Wipro and Ultratech Cement are up more than 2 per cent in trade.

V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said the biggest positive for the market in the near term is that the feared escalation in the Israel-Iran tension is unlikely to happen. The decline in Brent crude from $90 to $87 is a confirmation of this expected de-escalation.

However, the market is likely to be weighed by the high US bond yields which can trigger further selling by FIIs. Since large-caps constitute the lion's share of the AUM of FIIs, the pressure will be on large caps despite their relatively fair valuations, he said.

FII selling will provide opportunities to investors to slowly accumulate high-quality large caps like HDFC Bank which has reported good Q4 results with improving margins, he added.

"The Q4 results of autos, capital goods and cement companies will be good and the market can be expected to respond positively to the numbers," he said.

Deepak Jasani, Head of Retail Research, HDFC Securities, said Asian stocks opened mostly higher as the focus shifted to a slew of company earnings and economic data this week for insight into the direction of central bank policy.