May 17, 2004 was "Black Monday" for stock market investors; the Sensex plunged 840 points, almost 17 percent, in the wake of a comment by Communist leader AB Bardhan. Though the markets trimmed losses later to end at 5,069, down 564 points, it marked the beginning of tough times, after the BJP-led NDA lost, paving the way for a government supported by the Left parties.

Investors would still remember Bardhan's statement "Bhaad me jaye disinvestment ministry" (let the disinvestment ministry go to hell) that apparently triggered panic-selling. The markets were riding on hopes of a second term for the NDA that was actively pursuing disinvestment, triggering a rally from January that year. The results disappointed investors and Bardhan's statement shocked them.

A lot has changed since then — a second mandate for the UPA led by prime minister Dr Manmohan Singh in May 2009 and its loss five years later amid charges of corruption at high places and policy paralysis, paving the way for a BJP-led NDA. A record was created after almost three decades when a single party got a clear majority on its own. The BJP won 282 seats, a sharp rise from the 138 seats it won in the 2009 elections. The Congress saw its tally fall to a lifetime low of 44 seats.

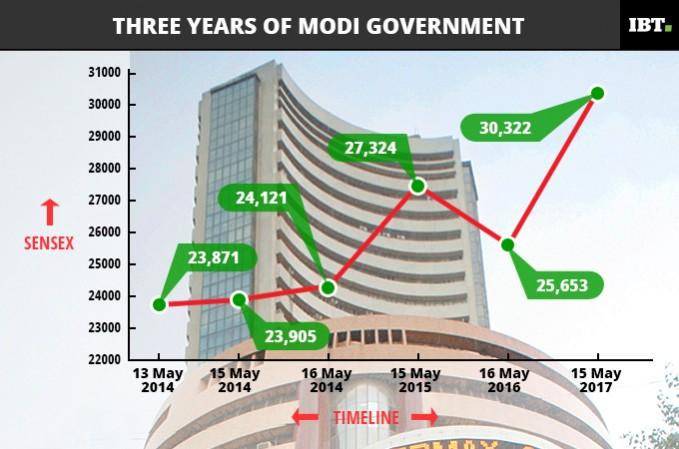

The stock markets had already started factoring an NDA win. When the results started trickling in on May 16, 2014, the indices had started rallying sharply. The BSE Sensex gained almost 1,450 points intraday to cross the 25,000-mark for the first time, but later gave up gains to close at 24,121, up 216 points. The NSE Nifty too was on a high, zipping past 7,500 before ending the day 80 points higher at 7,203.

The perceived pro-reform stance of Narendra Modi ensured that the markets stayed at elevated levels since then. On May 11, 2017, the 30-scrip Sensex hit lifetime high of 30,366.

The benchmark index closed at 30,322 on Monday, translating into a gain of 25.7 percent from the May 16, 2014 closing of 24,121.

Between the two timelines — May 16, 2014 and May 15, 2017 — it has been a rather stable journey for the Sensex, barring exceptions, like the one on September 29 last year when the government's announcement of surgical strikes on terror launchpads across the LoC saw the benchmark index plummet 465 points.

The other significant fall was on November 9 last year when the double whammy of demonetisation and Donald Trump's victory in the US presidential elections triggered a 1,580-point crash while the NSE Nifty plunged 540 points, in early session. The indices recovered losses later in the day.

While economic reforms have been there, the Modi government has not initiated the kind of "big bang" that investors and analysts expected from the dispensation, barring two sets of relaxation in foreign direct investment (FDI) norms, first in November 2015 and then in June 2016.

The initiative to relax FDI norms was specific in June when the government enhanced the limit for investments by foreign investors in defence and civil aviation.