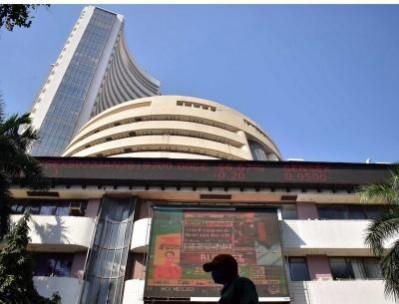

Sensex is now down almost 1,000 points in a broad based massive selloff in the markets.

BSE Sensex is trading at 72,691.46 points, down by 976.5 points or 1.33 per cent.

Deep cuts in PSU, power, infrastructure, metals, realty stocks have led to a sharp fall in the markets.

Among the Sensex losers, Powergrid is down more than 7 per cent, NTPC is down 6 per cent, Tata Steel is down more than 5 per cent.

Deep cuts are being seen across sectors. The PSU stocks index is down more than 7 per cent, utilities index is down more than 7 per cent, realty index is down more than 6 per cent, metals index is down more than 6 per cent.

This is adding to the misery in small caps which are down more than 5 per cent. Mid caps are down more than 4 per cent. SME IPO index is down more than 5 per cent.

The market breadth is very negative with 90 per cent of the stocks declining. As many as 1053 stocks have hit the lower circuit indicating the extent of the selling pressure.

V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said in the near-term investors should focus on the sustained weakness in the broader market, particularly the Small cap segment. The excessive valuations in these segments driven by the irrational exuberance of retail investors have been a concern for many months now. But it has taken the strong message from the regulator SEBI to trigger a correction in the Nifty Small cap index by 10 per cent from the February 8th peak.

(With inputs from IANS)