Search Results for: Uber Technologies Inc

CES 2014: Innovative Technology Trends to Watch Out For

Marijuana Sales Reach $1 Million on First Day in Colorado; Stocks Shoot Up

Intex Aqua Octa vs. Xolo Q3000 vs. Samsung Galaxy Note 3: Battle of Phablets Intensifies in India

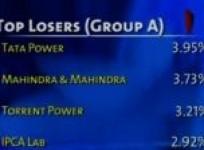

BSE closes points 6.03 down on Jan 3

Rumoured Micromax A350 Boasting Octa-core CPU Spotted at Benchmarking Site

Intex Launches First Indigenous Eight-Core CPU Smartphone Aqua-Octa in India; Availability and Price Details

Top 10 Achievements and Developments of Indian Military in 2013 [PHOTOS]

BSE closes points 62.87 down on Dec 30

Intex Aqua i4+ Dual-Core Android Jelly Bean Smartphone Launched in India

BSE closes points 271.45 up on Dec 18

Antarctica May Have Diamonds: Scientists Find Kimberlite Rock Known to Have Precious Stones

BSE closes points 50.40 down on Dec 17

New Test Detects Difficult-to-Diagnose Chronic Blood Cancer

Ducati Gears for Comeback in India, May Snap Ties with Precision Motors

Advertisement

Advertisement