The Authority of Advance Ruling (AAR) announced than 18 percent GST will be levied on all alcohol-based hand sanitizers despite classifying them as an essential commodity. AAR ruled that classifying any goods as an essential commodity won't qualify exemptions from GST.

Ever since the COVID-19 pandemic started, demand for hand sanitizers has skyrocketed and its sales grew 4 times more than what it was a year ago. According to Nielson India statistics, hand sanitizer sales touched Rs 43 crore in March this year as compared to Rs 10 crore a year ago.

With more and more players joining the hand sanitizer production, the Central Economic Intelligence Bureau alerted GST authorities about how the manufacturers classified hand sanitizers as medicaments instead of disinfectants - a move allegedly to evade paying higher GST. By classifying hand sanitizers under medicaments (tariff heading 3004) require manufacturers to pay 12 percent GST whereas 18 percent GST is levied on disinfectants (tariff heading 3808 of HSN - Harmonised System of Nomenclature).

With the latest ruling, consumers would have to pay 18 percent GST while buying hand sanitizers and manufacturers must classify them under tariff heading 3808.

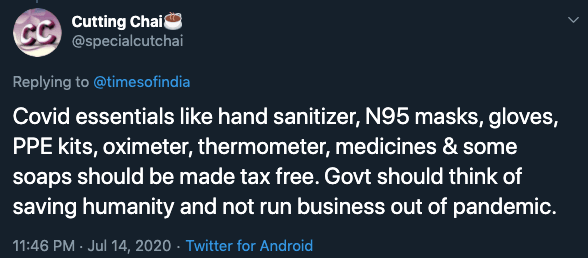

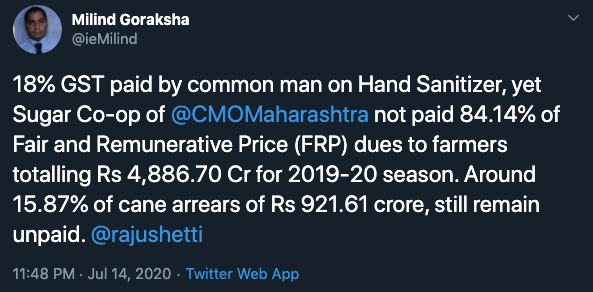

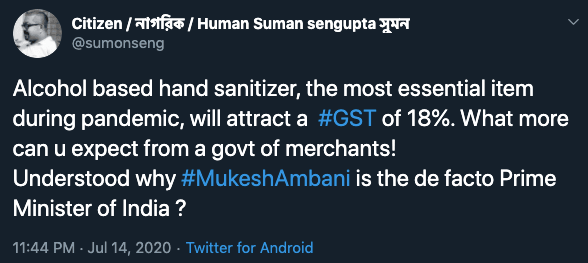

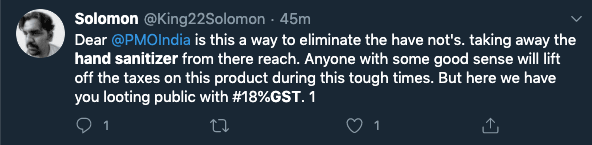

Indians outburst in anger

With the COVID-19 threat looming over everyone, face masks and hand sanitizers are the only effective ways to avoid getting infected. As per WHO advisory, hand sanitizers must have at least 60 percent alcohol to effectively kill the viruses in hand. This has led to a rapid increase in the usage of hand sanitizers, not just in India but across the world. With the 18 percent GST imposed on hand sanitizers, Indians have expressed deep angst.