Samsung may have been hit hard by the debacle of its ambitious product, the Galaxy Note 7 which was released in August, but it is still the market leader in India, topping the charts in terms of shipments in the Q3 2016. It has beaten the likes of Micromax, Lenovo, Reliance, and Xiaomi.

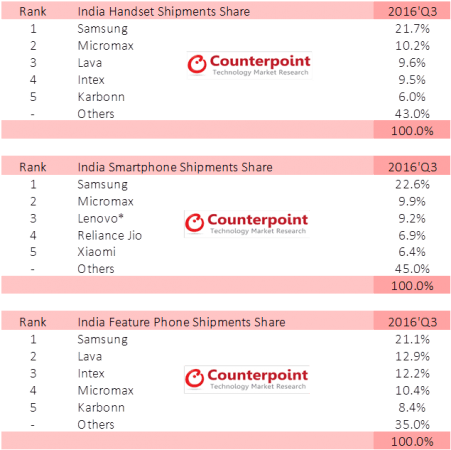

According to the findings by Counterpoint's Market Monitor service, Samsung has a 22.6 percent smartphone shipments share in India in Q3 2016, followed by Micromax (9.9 percent), Lenovo (9.2 percent), Reliance Jio (6.9 percent), and Xiaomi (6.4 percent). The company also leads in handset shipments share in Q3 with 21.7 percent, and 21.1 percent feature phone shipments share.

[READ: Samsung profits crash 30% in Galaxy Note 7 explosion]

Smartphone shipments in India grew 23 percent year-on-year and 21 percent quarter-on-quarter during the Q3 2016, while feature phone shipments grew 2 percent year-on-year and 23 percent quarter-on-quarter. The study also found out that two in three mobile phones and three in four smartphones shipped during the quarter were "Made in India".

The growth of smartphone shipment in India is huge compared to just 5 percent in global market.

"India witnessed record quarter for smartphone and featurephone shipments during Q3 2016. The demand for smartphones is being fueled by growing importance of being uber-connected which is further catalyzed by rollout of LTE networks. However, at the same time the demand for the featurephones also saw an uptick to satisfy the sizeable population which have been laggards in adoption of smartphones," said Karn Chauhan, Research Analyst at Counterpoint Research highlighting growth of market, in a statement.

"While bulk of the first-time smartphone users were mostly using Indian or Samsung-branded smartphone, but the aggressive entry and growth of Chinese brands have prompted most of these users to upgrade to affordable, but better spec smartphones. This has been possible because of Chinese brands adopting a direct and exclusive e-commerce channel strategy to be cost competitive," said Pavel Naiya, Analyst at Counterpoint.