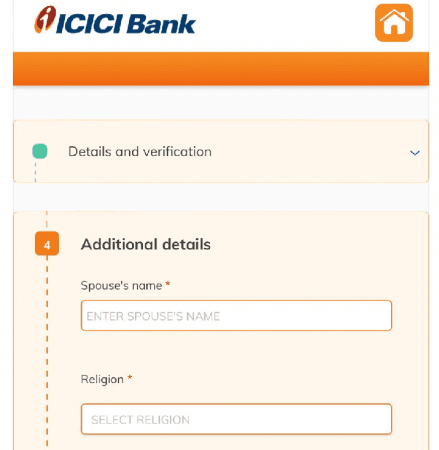

The credit card application form issued to customers while applying for a credit card from a leading Indian private sector bank lists 'Religion' as a mandatory piece of information to be provided as part of the KYC.

The form was posted by a concerned citizen on social media, asking why 'religion' was mandatory in the online form.

Amidst the growing number of debates on communalism and secularism in the country, this move is sure to add fuel to the fire by raising questions of potential discriminatory banking practices.

The debate from 2019:

The RBI's Regulations, 2018 on the Foreign Exchange Management (FEMA) Act requires customers with a Non-Resident Ordinary (NRO) account to state their religion in their 'Know your Customer' (KYC) details for certain purposes, particularly with regard to transfers of property. These changes were believed at the time to be linked to the Citizenship Amendment Act (CAA) especially due to the similar phrasing. The Amendment can be read to include citizens "of Afghanistan, Bangladesh or Pakistan belonging to minority communities in those countries, namely, Hindus, Sikhs, Buddhists, Jains, Parsis and Christians," who have relevant documents, permitting these groups to buy property in India.

As a result of widespread opposition to filling in 'religion' related details in 2019, Finance Secretary Rajiv Kumar, dismissed the doubts and clarified that "there is no requirement for Indian citizens to declare their religion for opening or existing bank account for KYC."

Fast Forward to 2024: The risks of having to list out a religious affiliation

The current issue raised is not so much connected with property as with the credit card services being offered by banks. There appears to be a disconnect between the FEMA purposes above and the general day-to-day bank service, which needs to be addressed.

The main point of contention here is the relevance of religion in opening a bank account or even applying for banking services like a credit card. Religion has no bearing on a person's ability to avail of bank services or their credibility in financial transactions and matters.

While taking the ex-Finance Secretary's statement on board, the mandatory nature of the requirement leaves a lot unanswered. In the absence of a clear explanation as to why this detail has been included and made compulsory; there is room for all sorts of speculation, with issues of bias, profiling and fundamental rights' violations being on top of the pressing concerns.

![Too drunk to walk? Karnataka to drop heavily intoxicated revellers home, sets up rest centres for New Year crowds [Watch] Too drunk to walk? Karnataka to drop heavily intoxicated revellers home, sets up rest centres for New Year crowds [Watch]](https://data1.ibtimes.co.in/en/full/826552/too-drunk-walk-karnataka-drop-heavily-intoxicated-revellers-home-sets-rest-centres-new-year.png?w=220&h=135&l=50&t=40)

![Too drunk to walk? Karnataka to drop heavily intoxicated revellers home, sets up rest centres for New Year crowds [Watch]](https://data1.ibtimes.co.in/en/full/826552/too-drunk-walk-karnataka-drop-heavily-intoxicated-revellers-home-sets-rest-centres-new-year.png?w=220&h=138)

![Too drunk to walk? Karnataka to drop heavily intoxicated revellers home, sets up rest centres for New Year crowds [Watch]](https://data1.ibtimes.co.in/en/full/826552/too-drunk-walk-karnataka-drop-heavily-intoxicated-revellers-home-sets-rest-centres-new-year.png?w=220&h=135)