Midway through the world's largest election, investors are getting anxious about its impact on their portfolio. India is voting for the new government which may well decide the trajectory of the economy for the next five years. Post completion of three phases at the time of writing, 303 constituencies of 543 have completed polls, and another 71 constituencies from nine states voted in the fourth phase on April 29. About 55 per cent of the country's electorate has been cast. Markets, psephologists and political analysts are trying to analyse and predict the outcome of the elections. However, the record of opinion polls, as well as exit polls, has been mixed and thus investors are likely to stay on edge till May 23 when results are announced.

There is a lot to worry about the global equity markets- the business cycle is maturing and what appears to be a slowdown may turn out to be a recession, and then there is the rise of protectionism resulting in trade wars, as well as fears of oil prices rising due to supply cuts. In this scenario, Indian markets with a stable economy would be attractive; however, with elections around the corner, politics has become a driver. Market participants would prefer a stable government which can push reforms and drive economic growth. The recent uptick in our markets may be attributed to rising expectations of a stable government, thereby making foreign players invest around Rs 54,000 crore (as on April 23) into our equity markets for the current calendar year.

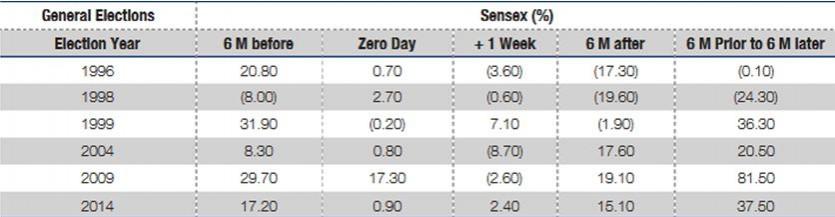

While many may believe that high volatility and uncertainty persists around elections season, however, only two instances of past six elections (2004 and 2009) we have seen sharp moves in the week of election results. Of course one needs to evaluate the impact of elections on a slightly longer time horizon.

We find that equities have delivered positive returns in 6 months after elections have been positive. In the four most recent elections, an investment made six months prior to elections has yielded positive returns when the investment up to six months after the elections. The market didn't react positively to the results in 1996 and 1998 as the coalition after the elections was not stable and the government didn't last a full term. After the 1999 elections, markets were still worried about the stability of the coalition and the dot com bubble burst played a role as well.

From a longer-term perspective, markets generally focus more on the macro-economic parameters and earnings on the companies, and the importance of elections is largely limited to policy making that impact the macro-economic environment that companies operate in.

There are a few caveats, firstly the Indian economy is more globalized than in the past, so the external environment is also important. Many of the large-cap firms have significant global operations and are export driven and profits are linked to global trends. This is especially true of sectors like IT, petrochemicals, automotive, metals and pharma where companies have expanded their businesses overseas and their top line and bottom line numbers are driven by their global business dynamics. However, banking, financial services, capital goods and consumer stocks are more domestically oriented. These companies have revenues driven by macroeconomic parameters like inflation, interest rates, monsoons, and are slightly more dependent on policymaking.

Recent reforms like GST, IBC, RERA etc have held back growth in the short term, but are likely to pay off over the coming years. With the size and liquidity of Indian markets improving, India is increasingly on the radar of foreign investors. Around 40 per cent of the shareholding of our large-cap companies is being held by foreign players and their allocation towards equities is mainly dependant on other asset class performances. Most of the investment of FII's is in large caps, whereas for mid caps and small caps participation of domestic investors is important.

Small and mid-cap companies are more exposed to the domestic economy as well. Also, lower trading volumes on the exchanges for these small and mid-cap companies make them more volatile and more sensitive to the election outcome.

From a trader's point of view, Indian volatility barometer India VIX has doubled from the levels of sub 13 in the month of March to the current levels of 25 – 26, indicating participants are expecting more uncertain moves ahead of result outcome on May 23. Higher VIX indicates markets may swing swiftly on either side. VIX generally rises due to uncertainty around any event. The recent surge in crude oil prices and foreign players booking out profits has been a dampener on markets.

As far as the elections are concerned, as long as a stable, reform-oriented government were to come to power, markets are likely to react positively. Markets generally move on liquidity in the short term, while long term trends are mapped on the macroeconomic parameters and companies performances. Investors would do well investing in equities and should consider mid caps as well as sectors with domestic exposure like banking, autos and capital goods.

[Rajiv Singh is the CEO of Stock Broking, Karvy. The views and opinions expressed in this article are those of the author's and do not reflect that of International Business Times, India]

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)