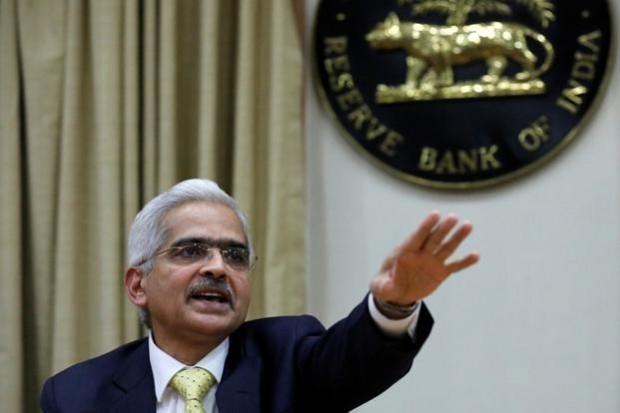

The Reserve Bank of India (RBI) will remain vigilant and strive to revive growth in Asia's third-largest economy, as well as pushing to maintain macroeconomic, financial and price stability, its governor said in a speech on Friday.

India lost momentum in the final quarter of 2018, reducing its annual rate of economic growth to 6.6 per cent, the slowest pace in five quarters and much less than expected.

But RBI Governor Shaktikanta Das said the country's real gross domestic product (GDP) growth was expected to reach 7.2 per cent in the fiscal year to March 2020, which he described as the strongest among the world's large economies.

India's annual retail inflation rate rose in March to 2.86 per cent, from 2.57 per cent in the previous month, but remained below the central bank's target for an eighth straight month, increasing the chances for a key interest rate cut in June.

"Inflation has remained below target, averaging 3.6 per cent for the period under the inflation targeting framework so far," Das said in the speech, uploaded on the RBI website early on Saturday. He said he was referring to the period from October 2016 to February 2019.

The RBI has lowered its retail inflation forecast to 3.8 per cent by January-March 2020 but warned it could be higher if food and fuel prices climb abruptly, or if fiscal deficits overshot targets.

India's current account deficit is expected to be around 2.5 per cent of GDP in 2018-19 and the gross fiscal deficit has kept to budgetary targets, he added.

Das underscored the risks facing emerging market economies such as a India as global growth and trade weaken.

"There is considerable uncertainty as to whether this weakness is temporary or the beginning of a recession in advanced economies," Das said, adding that central banks around the world were not tightening monetary policy, with some even promoting easier lending conditions.

The RBI cut its policy interest rate by 25 basis points earlier this month, in a widely expected move to boost the economy at a time Prime Minister Narendra Modi is seeking a second term in a national election.

Emerging market economies also remain exposed to financial market volatility, Das said, and financial conditions could heighten existing stress on the balance sheets of lending institutions in some countries.