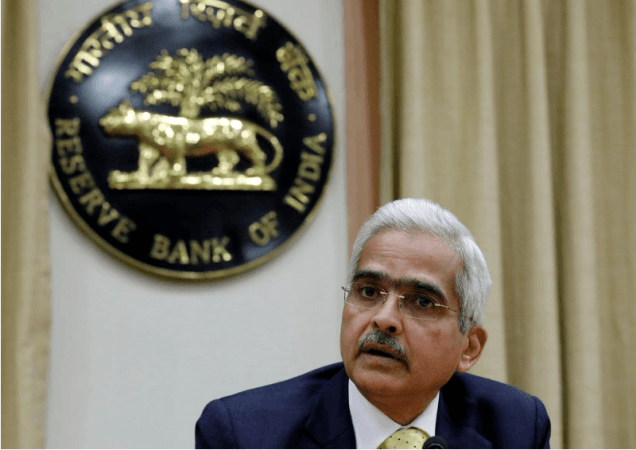

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Thursday, August 6, maintained that the Monetary Policy Committee decided to keep key rates including the repo rate unchanged while maintaining an accommodative stance.

Accordingly, the repo rate or short-term lending rate for commercial banks and reverse repo rate remain unchanged at 4 per cent and 3.3 per cent, respectively.

The MPC voted to maintain an accommodative stance, thus opening up possibilities for more future rate cuts.

'RBI will do whatever is required to revive economy'

Shaktikanta Das said that the RBI will do whatever is required to revive the economy in the wake of the coronavirus pandemic.

"With Covid-19 infections rising under fragile micro-economic and financial conditions, we propose to take regulatory and developmental measures, enhance liquidity support for financial markets, ease financial stress while strengthening credit discipline, improve the flow of credit, deepen digital payment systems and facilitate innovations by leveraging technology," the RBI Governor added.

Das also informed that the central bank is consulting an expert committee headed by KV Kamath for resolution plans with detailed guidelines. He said there is enough liquidity at present and that the RBI is using several other monetary operations to boost liquidity.