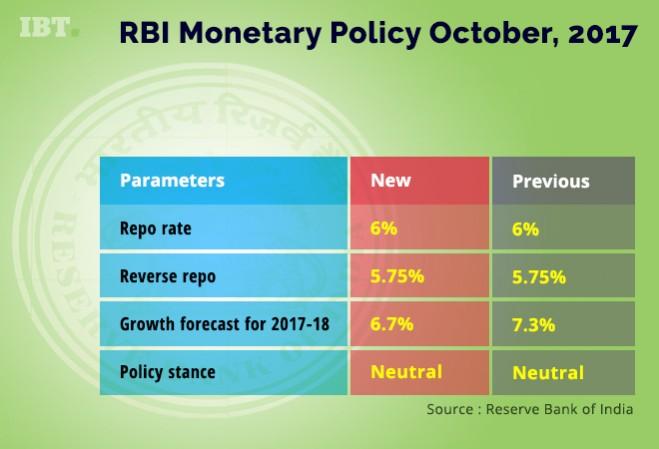

As anticipated, Reserve Bank of India's Monetary Policy Committee (MPC) on Wednesday chose to maintain the status quo by keeping the repo rate unchanged at 6 percent, despite concerns of a slowdown in the economy.

Following the decision, the benchmark repo rate stands at 6 percent, and the reverse repo rate remains unchanged at 5.75 percent. The RBI maintained a neutral policy stance.

Of the six-member MPC, five members voted in favour of status quo, while Ravindra Dholakia voted in favour of a rate cut.

"The decision of the MPC is consistent with a neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index inflation of 4 percent within a band of +/- 2 percent, while supporting growth," RBI Monetary policy statement said.

The most unprecedented decision in the latest RBI monetary policy meeting is the slashing of the growth outlook for the current year from 7.3 percent to 6.7 percent.

"Aggregate demand has been impacted by slowing consumption demand, still subdued investment and a slump in export performance in the early months of 2017-18. Manufacturing activity, which was dragged down by one-off effects of the implementation of GST, weighed heavily on aggregate supply conditions..." the RBI said in its Monetary Policy Report.

The MPC also raised its inflation forecast marginally. The RBI now expects CPI inflation expected to pick up to 4.2 percent in the third quarter of the fiscal 2018 and 4.6 percent in fourth quarter, a mildly up from its earlier forecast of 3.5-4.5 percent inflation in the second half of the year.

With the Gross Domestic Growth (GDP) slipping to 5.7 percent for the April-June quarter from 7.9 percent in the same quarter last year, the Central government wanted another possible rate cut from the RBI, with an aim to help the economy recover from its current low and to increase lending activities.

The RBI in its policy statement said that it expects the services sector to provide a counterbalance to persisting weak industrial growth. Further events like demonetisation and the GST implementation played out a dampening role which further aggravated the economic condition.

The Indian rupee hits its six month low week to 65.75 levels to a dollar. Foreign institutional investors (FIIs) turned sellers past two months, they sold around Rs 11,050 crore ($1.7 billion) in August and another Rs 7,150 crore ($1.1 billion) till 27 September. But these two factors won't trouble RBI much, because as of June 30, it has $402 billion in its foreign exchange reserves.

Showing concern over the lack of investment demand in the economy, the RBI said that it was "imperative to reinvigorate investment activity", which, in turn, would revive the demand for bank credit. "Recapitalising public sector banks adequately will ensure that credit flows to the productive sectors are not impeded and growth impulses not restrained," the central bank said in the monetary policy statement.

Following the monetary policy meeting, the capital market reacted positively, with the benchmark BSE Sensex up by around 215 points while Nifty 50 index up 65 points.