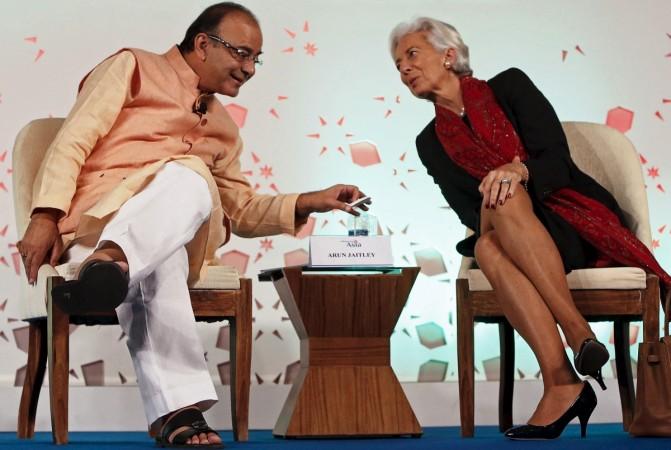

International Monetary Fund (IMF) chief Christine Lagarde's unexpected support for cryptocurrencies is unlikely to inspire a change in the Indian regulator's view that it is not legal tender.

Union Finance Ministry and the Reserve Bank of India have been stridently opposing the cryptocurrencies and closed the entire banking system to cryptocurrency transactions.

The authorities also shuttered the nation's first cryptocurrency ATM announced in Bengaluru and arrested a promoter of the company that set up the ATM. The police also conducted raids and seized equipment including laptops, mobile phones and credit cards.

Lagarde's rationale for supporting cryptocurrencies is because they could ease the path to financial inclusion in developing economies and even among the poorest of the western world. Though these objectives align with the avowed objectives of the Indian government, that alone is unlikely to bring about a change of mind.

The IMF support had a positive impact on most cryptocurrencies and the more prominent among them like Bitcoin and Eutherium made handsome gains on Wednesday.

Lagarde has sought to make a case for governments to support digital currencies as private players do not have the credibility to offer cryptocurrency services. She wanted national governments to step in to prevent the digital currency systems from becoming a haven for fraudsters and money launderers.

Marshall Islands

Lagarde's newfound enthusiasm for the digital currency, some say, is in contrast with the IMF's recent opposition to the Marshall Islands' plans for a sovereign digital currency. The IMF criticised the plan and said it feared the island nation's currency could be used by crime syndicates or businesses running illegitimate operations.

In an address to the Singapore Fintech Festival on Tuesday, echoing a recent IMF study on the digital economy, Lagarde said central banks had to work quickly to establish digital cash for growing networks of private financial transactions. Otherwise, the government risked such networks mushrooming into inherently unstable ones.

A system regulated by central banks, Lagarde said, could become the basis for a fast expansion of financial services to the developing world and even to the poorest in western societies. This would reduce the risks associated with privately managed digital currencies.

Outside mainstream banking

The digital currency operators, meanwhile, are likely to approach the IMF's change of heart with scepticism. For them, the technology's main attraction is that it lies outside the mainstream banking system. The involvement of a central bank could bring in heavy-handed regulate slowing transactions and raising the costs.

However, there is a section of businesses that wish to use the underlying blockchain technology of cryptocurrencies to process transactions and may welcome the IMF's endorsement and the national regulators' involvement.

As a beginning, some point to the Bank of England's oversight of cash and coins that a digital currency is expected to replace. The regulator is also watching developments in digital currencies closely and already runs systems that process the stock exchange and banking transactions.

Sweden's central bank has run some tests and the IMF has credited Canada, China and Uruguay as also going ahead with plans to provide a digital currency.

Lagarde said central banks could take over the processing of transactions while private-players could continue to providers innovative services to customers.

Friendly user experience

"The advantage is clear. Your payment would be immediate, safe, cheap, and potentially semi-anonymous. And central banks would retain a sure footing in payments. In addition, they would offer a more level playing field for competition, and a platform for innovation. Meanwhile, your bank or fellow entrepreneurs would have ensured a friendly user experience based on the latest technologies," Lagarde said.

"We float through a world of information, where data is the 'new gold', despite growing concerns over privacy and cyber-security. A world in which millennials are reinventing how our economy works, phone in hand. And this is the key; money itself is changing. We expect it to become more convenient and user-friendly, perhaps even less serious looking," she added.