Thinning of markets, liquidity crunch and volatility in financial markets has impacted trading since nationwide lockdown was imposed on March 23, to contain and curb the spread of coronavirus pandemic.

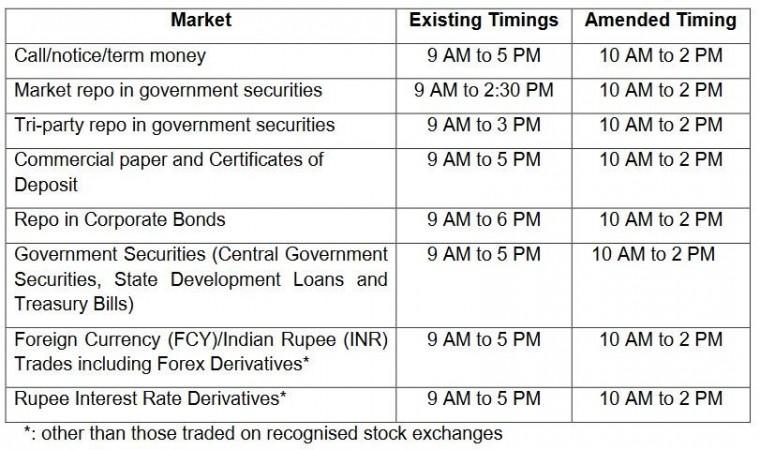

Owing to sluggish financial market activity in the past weeks, the Reserve Bank of India (RBI) has decided to cut down on the money market trading hours at exchanges, to include Forex trading from April 7 to April 17. The new operational hours that will come into effect inclusive of both the start and end date is from 10 am to 2 pm only.

Money market trading hours changed: Why?

This move is necessitated to ensure that market participants maintain adequate checks and supervisory controls while optimising thin resources, risks are minimized and the safety of personnel is ensured. RBI further clarified that, "This move will not impact the regular banking services for customers that include - the RTGS, NEFT, e-kuber and other retail payments systems. They will continue to be available as per extant timings."

The revised trading hours for various markets are as follows:

A press statement by the RBI said, "The unprecedented situation created by the COVID-19 outbreak has necessitated lockdowns, social distancing, restrictions on movement of people and non-essential activities, work from home arrangements and business continuity plans. The resultant dislocations have adversely impacted the functioning of financial markets. Staff and IT resources have been severely affected, posing operational and logistic risks. The thinning out of activity is impacting market liquidity and increasing volatility of financial prices."

Other measures implemented by RBI to deal with Covid-19

Presently the value of the goods or software exports made by the exporters is required to be realized fully and repatriated to the country within a period of 9 months from the date of exports. In view of the disruption caused by the COVID-19 pandemic, the time period for realization and repatriation of export proceeds for exports made up to or on July 31, 2020, has been extended to 15 months from the date of export. The measure will enable the exporters to realise their receipts, especially from COVID-19 affected countries within the extended period and also provide greater flexibility to the exporters to negotiate future export contracts with buyers abroad.

RBI has constituted an advisory committee led by the chairman, Sudhir Shrivastava to review the Ways and Means (WMA) limits for State Governments and Union Territories (UTs), which will be increased by 30 percent from the existing limit to tide over the situation arising from the coronavirus outbreak. The revised limits will come into effect from April 1, 2020 and will be valid till September 30, 2020.

The framework on the countercyclical capital buffer (CCyB) was put in place by the RBI in terms of guidelines issued on February 5, 2015 wherein it was advised that the CCyB would be activated as and when the circumstances warranted, and that the decision would normally be pre-announced. Based on the review and empirical analysis of CCyB indicators, it has been decided that it is not necessary to activate CCyB for a period of one year or earlier, as may be necessary.