A slew of positive news, starting with the record victory of the BJP in Uttar Pradesh and Uttarakhand and later on sustained by bullish trade data for February and progress made in the implementation of the GST, lifted stock and currency markets to record highs this week.

The rupee also spurted on the back of sustained dollar inflows arising out of heavy buying by foreign institutional investors (FIIs/FPIs).

The two benchmark indices, BSE Sensex and NSE Nifty, ended with significant gains; the Sensex rose 702 points during the truncated week to close at 29,649, just 375 points away from its lifetime high of 30,024.

The 50-scrip NSE Nifty gained 225 points during the week to a record closing high of 9,160.

Top Sensex gainer on Friday was cigarette maker ITC, ending 4.85 percent higher at Rs 281. Interglobe Aviation, the owner of budget carrier IndiGo, gained 3.42 percent to close at Rs 922 on news that it may convert more Airbus A320neos to A321neos.

After rising sharply since Tuesday and reaching a 16-month high, the rupee shed gains amid global cues to close at 65.46 to the US dollar.

FIIs were net buyers of Indian equities worth Rs 1,360 crore on Friday, according to provisional data published by the National Stock Exchange (NSE).

On Friday, the government also came out with statistics on foreign tourist arrivals (FTAs) into India last month. The data showed FTAs increased 13 percent to 9.56 lakh from 8.47 lakh in February 2016. Bangladesh was the top source country; 17.46 percent of the FTAs were from the neighbouring country. The UK and the US were the next source countries.

The BJP finalised its chief minister for Uttarakhand on Friday in Trivendra Singh Rawat. The party will be taking a call for Uttar Pradesh on Saturday.

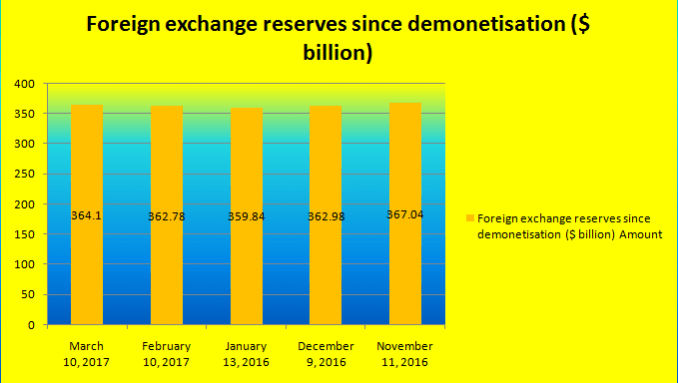

India's foreign exchange reserves rose $98.6 million to end at $364.10 billion as of March 10, 2017. The reserves have more or less remained stable over the past few months, despite the Modi government's decision to demonetise Rs 500 and Rs 1,000 notes. There was a concern that the move would trigger a flight of capital over uncertainty perpetrated by the radical step.