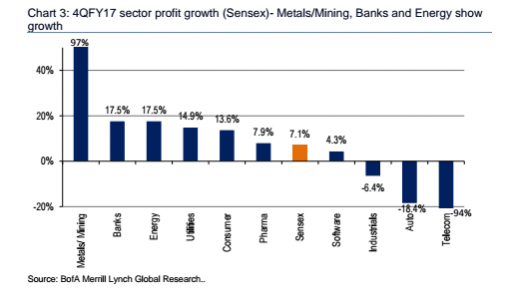

In line with forecasts of metal prices rising steadily, analysts have come out with upbeat projections for the March 2017 quarter (Q4) earnings for metal companies. While Motilal Oswal Securities Ltd. (MOSL) said that the companies could post their best net profit numbers in 19 quarters, the rise could be 97 percent on a year-on-year basis, according to Bank of America Merrill Lynch (BofAML).

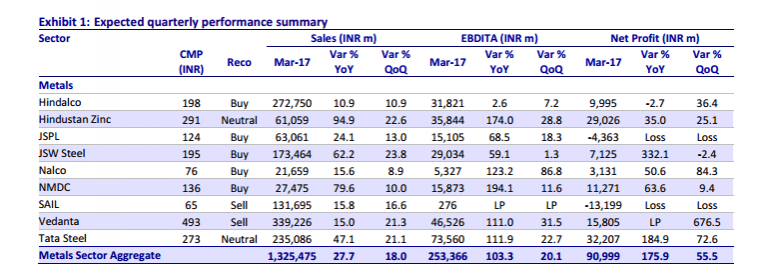

"Metals are expected to post 2.8x jump in PAT, or profit after tax, to Rs 91b (Rs 9,100 crore), the highest in 19 quarters (~five years)," MOSL said in a note.

The uptrend in global steel prices, projected by the World Bank to remain for the entire calendar year, was witnessed in India as well.

"Retail flat steel prices were up ~8% QoQ or Rs 3,000 per ton in 4QFY17, driven by higher exit prices in 3Q. Flat steel product prices increased by ~Rs 2,000/t at the beginning of the quarter, but lost momentum in the subsequent months due to weak domestic demand and lower input product prices. Long steel product prices recovered from the impact of demonetization," MOSL said.

Globally, metal prices are expected to rise after a 6 percent fall in the calendar year 2016.

"Metal prices are projected to increase by 11 per cent in 2017 due to tightening markets for most metals, especially those facing imminent resource constraints," a World Bank study released in January this year, said.

For aluminium, support came from China.

"Among base metals, aluminium LME was up 8% QoQ to $1,848/t, primarily led by higher input cost of coal and alumina for Chinese smelters. Spot premiums also moved up, leading to an all-in aluminium increase of 12% QoQ to $1,951/t. Alumina price average was up ~12% QoQ to $341/t," MOSL said.

Nalco, Tata Steel and Vedanta likely top performers

Higher volumes and better prices during the quarter would make these firms outperformers within the metals space.

Nalco's operating profit margin is likely to double sequentially to Rs 350 crore, while Vedanta could see its margin go up 23 percent to Rs 7,300 crore "led by strong volume- and price-led growth in zinc, aluminum and crude oil," MOSL said, adding, "Zinc business profitability is likely to be boosted by 11% higher mine output and LME gains. Aluminum volumes are expected to increase 15% QoQ."

Aditya Birla Group company Hindalco's standalone operating profit margin is projected to rise 7 percent sequentially to Rs 3,200 crore.

BofAML said that the metals space is likely to be the best sector in terms of net profit growth for March quarter.