Infosys will be leading the IT pack's third quarter (Q3) results on January 13, 2017, amid expectations of a tepid performance by brokerages. Tech Mahindra and HCL Technologies are expected to outperform their peers in the seasonally-weak quarter.

Also read: MMRDA invites bids for 2 more metro lines project in Mumbai

On Thursday at around 12 noon, the BSE Information Technology index was trailing the Sensex; while the 30-scrip benchmark index was up 0.85 percent at 26,859, the IT index was trading with gains of 0.41 percent.

Top players in India's $145 billion IT software services industry, represented by Nasscom, include Tata Consultancy Services (TCS),Infosys, Wipro, HCL Technologies, Tech Mahindra, Mindtree Consulting, Zensar Technologies, Mphasis and L&T Infotech.

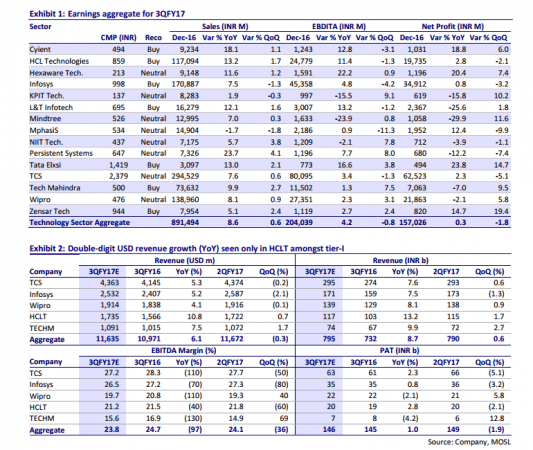

Motilal Oswal Securities Ltd. (MOSL), Nomura and IDBI Capital Markets & Securities have come out with their estimates in the past few days and the estimates are not bullish.

Nomura (NFASL) analysts Ashwin Mehta and Rishit Parikh wrote that revenue growth in dollar terms for tier-1 IT (including CTSH) is likely to hit a 13-quarter low at 6.9 percent YoY (vs the previous peak of 15.4 percent YoY.

They flagged key areas to watch out for when the companies declare their December quarter results.

"BFSI demand, where outlook has moderated across companies, telecom uptick sustenance, where client financials are not showing improvements, signs of healthcare slowing, as client financials weaken and Payer M&A/Obamacare repeal uncertainty hurts, across services continuation of strength in IMS/Engg services and weakness in ADM/EAS," they wrote.

Here is the company-wise preview:

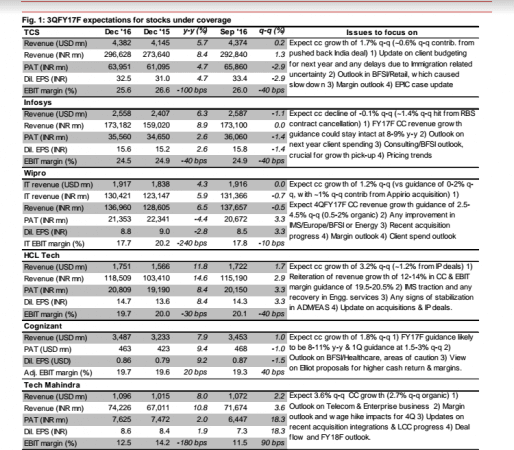

Tech Mahindra is expected to post 3.1 percent sequential growth in constant currency (CC) terms to $1,091 million, said MOSL, while IDBI Capital Markets estimates it at 3.5 percent CC growth sequentially, lead by core-business growth, enterprise segment and M&As. Net profit is likely to come at Rs 727 crore, translating into a growth of 12.8 percent sequential growth, added MOSL.

Infosys is likely to post 1 percent fall in revenues in constant currency terms to $2,532 million on account of seasonal weakness and the RBS ramp-down, according to MOSL. The Bengaluru-based company's revenues projections by IDBI Capital Markets is similar, a decline of 0.6 percent QoQ in CC terms, triggered by the likely 120 bps impact of ramp-down of RBS's W&G contract.

The company's net profit is projected to decline by 3.2 percent QoQ to Rs 3,490 crore, said MOSL. Infosys is likely to retain its 8-9 percent revenue growth in CC terms, while its deal wins and progress on automation and digital services growth have been highlighted as worth watching out for, by IDBI Capital Markets.

"Any cut in growth guidance or EBIT margins below 24% levels would be taken negatively," the Nomura analysts said.

Wipro could post 1.3 percent growth fall in revenues in CC terms on a sequential basis to $1,914 million, aided by 0.3 percent QoQ CC organic growth from Appirio (1-month revenue) and net profit is expected to come in at Rs 2,190 crore, driven by 5.8 percent QoQ growth on account of improved profitability and higher other income, MOSL said in its preview note. IDBI Capital Markets has projected 1.5 percent QoQ revenue growth in CC terms to $2,032 million. "We expect consolidation of Appirio to add $15 milliion to the revenue," the brokerage said in its note.

TCS, India's biggest IT software services exporter, would end up with 1.5 percent growth in CC terms to $4,363 million, helped by $27 million revenues from an India-based project that was deferred earlier; net profit is estimated to have declined 5.2 percent QoQ to Rs 6,250 crore, MOSL said. The revenues are estimated at $4,370 million, translating into a growth rate of 1.2 percent sequential growth in CC terms, according to IDBI Capital Markets.

"We currently do not expect any material acceleration in FY18F and build below-guided range margins in FY18F. We see downsides to street growth and margin expectations and find valuations at 17.4x FY18F (EPS of INR135.8) expensive, especially in light of higher risks, if US raises H1-B salaries," Nomura analysts wrote. Their revenue estimate is $4,382 million.

HCL Technologies is expected to post 2.1 percent growth in CC terms to $1,735 million, with net profit estimated at Rs 1,937.5 crore, down 2.1 percent, QoQ, according to MOSL. The revenues are likely to come in at $1,741 million at 2.5 percent growth rate sequentially, IDBI Capital Markets said.

Stock recommendations

MOSL: Buy rating for Infosys, HCL Technologies, Tech Mahindra, Zensar Technologies; neutral for TCS, Wipro and Mindtree.

Nomura: Buy rating for HCL Technologies; neutral for Infosys, TCS, Tech Mahindra and reduce for Wipro.

Estimates by Nomura:

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)