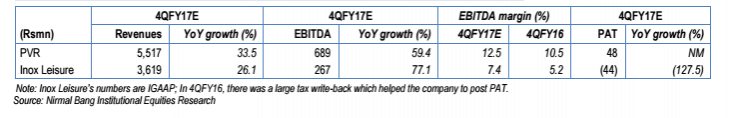

Multiplex chains PVR and Inox Leisure are expected to have performed well during the March quarter, a seasonally weak one in India. Topline growth is likely to come above 25 percent along with better margins at the operating level, aided primarily by a slew of box office hits, steady shift towards watching films at multiplexes and huge entry barriers for new players, according to an update by brokerage Nirmal Bang Institutional Equities (NBIE).

The ticket sales for the two multiplex chains were boosted by box office successes that include Shah Rukh Khan-Mahira Khan's Raees, Hrithik Roshan-Yami Gautam's Kaabil and Badrinath ki Dulhania starring Varun Dhawan and Alia Bhat. Actors also show greater involvement in promoting their films, boosting box office collection.

The four multiplex chains — PVR, Inox Leisure, Mexico's Cinepolis and SRS Cinemas — have a oligopoly-like hold, controlling 70 percent of the cinema screens in India, ensuring steady business for many years to come, wrote NBIE analyst Girish Pai in his note.

"This industry's structure will deliver steady revenue growth, and improve margins as well as RoIC over a long period of time. PVR and Inox Leisure (the two large players) can deliver in the next 10 years at least 5%-10% volume/footfall growth (new screen-driven, attracting both single-screen and new generation customers), respectively, with rise in realisation of 4%-5%," he said.

Arguing that the two listed entities — PVR and Inox Leisure — deserve a higher valuation, Pai said that with the possibility of a lower tax once the Goods and Service Tax (GST) regime kicks-in, things could only get better for the two players.

In Pai's view, "this industry, a highly taxed one, will benefit if the GST is levied in a benign manner and input tax credit is allowed."

The movies lined up for the first quarter of the current financial year include Tubelight starring Salman Khan and Zhu Zhu and Baahubali 2 featuring Prabhas and Rana Daggubati.

PVR currently has 579 screens in 126 properties while Inox Leisure owns about 445 screens in 113 multiplexes. Cinepolis had planned to take its screen count to 400 by the end of December 2017 from 340 in May last year.

For investors, the returns are expected to be good given the existing players enjoy good pricing power in view of little competition in the form of new players entering the lucrative business.

These multiplexes have also seen to put their demonetisation blues behind, according to the analyst. "From our interactions with Inox Leisure's management during the quarter, we came away with the feeling that footfalls have recovered from the sharp decline witnessed post demonetisation. We believe the situation has now normalised with signals of improved cash availability in key cities and greater usage of credit/debit cards," Pai wrote.