The Public Sector Banks (PSBs) in India have reported losses of Rs 95,800 crores between April to September, Finance Minister Nirmala Sitharaman said on Tuesday. The PSBs reported 5,743 cases of fraud in the period, most of which had taken place over the last several years. Although around 1,000 cases worth 2,500 crores were reported recently.

"Government has taken comprehensive measures to curb the incidence of fraud in banks," Sithraman said in Rajya Sabha. Measures included the freezing of 338,000 bank accounts of inoperative companies in the last two financial years and the enactment of a law with a provision to confiscate the property of those found to have committed fraud and who have fled the country.

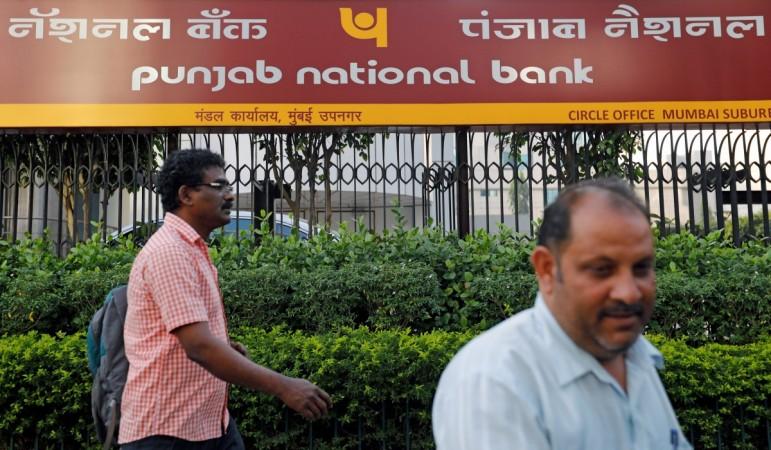

State Bank of India reported fraud of Rs 25,400 crores followed by Punjab National Bank of Rs 10,800 crores and Bank of Baroda of Rs 8300 crores. Lax regulations and some bankers' bonhomie with fraudsters has been blamed for the loss.

What are the regulations?

Prime Minister Narendra Modi introduced a tough bankruptcy and insolvency law in 2016, and fugitive economic offenders law aiming to help banks recover losses from fraud amounting to near $140 billion.

Punjab National Bank, India's second-biggest state-run bank, reported more than $2 billion losses through fraud last year alleging that a few rogue employees had issued fake bank guarantees over several years to help jewellery groups raise funds in foreign credit.

(With agency inputs.)