Demonetisation worked wonders for financial savings such as insurance, mutual funds and bank deposits, bringing cheers to entities in these businesses. Life insurance premium collection growth rate hit a nine-year high in 2016-17. "FY2017 was the best year for private life insurance players since FY2008," Kotak Institutional Equities said in a note.

Private life insurers such as ICICI Prudential Life Insurance, HDFC Life, Max, Reliance outpaced state-run insurer Life Insurance Corporation of India (LIC) in life insurance premium collection during 2016-17, marking the best year since 2008.

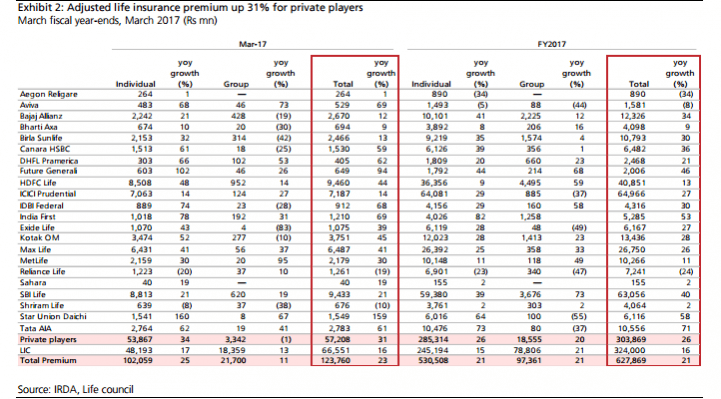

While private insurers reported 26 percent growth in APE, LIC saw 16 percent increase, resulting in the overall industry growth of 21 percent.

Annual Premium Equivalent (APE) refers to the sum of the initial premium on new annual-premium policies, plus one-tenth of premiums on new single-premium policies. It is a key metric to measure performance of life insurance companies worldwide.

A key feature during the financial year was the spurt in insurance premium collection after demonetisation announced last November.

"Demonetisation has clearly been a positive trigger (33% y-y growth over the past five months for private insurers), and listed insurance companies, in our view, remain good plays on increasing financial savings rates over the longer term," Nomura analysts Adarsh Parasrampuria and Amit Nanavati said in a note on Wednesday.

"Strong capital markets, shift to financial savings and increase in bank balances fuelled by demonetisation led to high growth for almost all players; the only exception being Reliance Life (down 24%) that is consciously slowing down," Kotak Institutional Equities said in a note.

In March 2017 also, private insurers grew at a higher clip of 34 percent as against LIC's 17 percent.

For 2016-17, ICICI Prudential Life Insurance — a joint venture between private sector lender ICICI Bank and Britain's Prudential Corporation Holdings Limited — saw its APE grow 29 percent.

"ICICI Life reported some weakness with 14% individual APE growth after a massive run (28-79% since November, i.e. demonetisation) translating into 29% growth for the year versus 25% baked in our forecasts," Kotak said in its note.

Max Life's growth rate was 26 percent while SBI LIfe Insurance's business grew 39 percent.

The momentum is likely to be sustained in the current fiscal also for the entire life insurance segment. "We expect current momentum in life insurance/capital market inflows to continue in FY2018E as investors continue to shift to financial savings from physical savings," Kotak said.

In a separate note, Motilal Oswal Securities Ltd. said that inflows into mutual funds rose substantially during 2016-17 to hit a record high of Rs 18.3 lakh crore as of March 31, 2017.

The deposit surge triggered by demonetisation of Rs 500 and Rs 1,000 notes saw overall bank deposits reach 11.75 percent in 2016-17, up from 9.72 percent in the preceding fiscal, according to RBI data.