As per industry statistics, almost 60% of all online transactions are made using UPI apps, such as PhonePe or Google Pay. A number that is only expected to go higher in the coming years, up to almost 75%. However, a new UPI innovation has the likes of PhonePe and Google Pay losing sleep over the new innovation.

What is UPI Plugin?

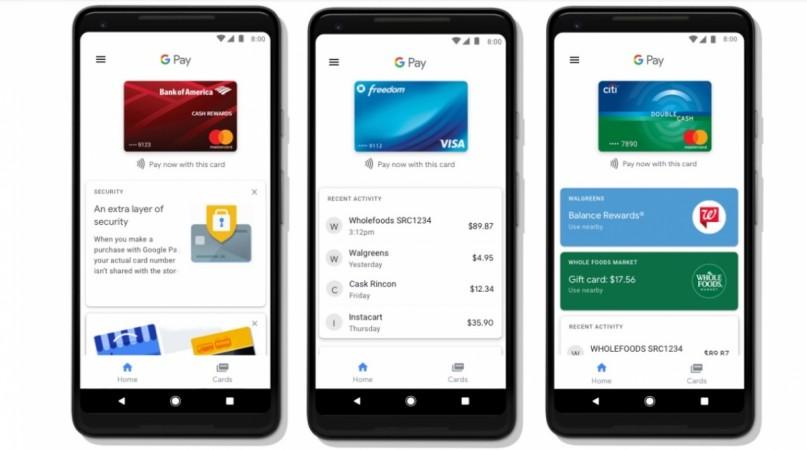

UPI Plugin aims to enable faster, seamless payments, by obviating the need for customers to go to a third party app. It enables online merchants to add a virtual payment address wherein they collect money without having to use payment apps. Currently, UPI apps, especially PhonePe and Google Pay, enjoy dominance on the mobile payments platform. The new development could potentially challenge their duopoly. Probably making the PhonePe founder Rahul Chari pen his reservations in a blog. In the blog he mentions why Unified Payments Interface (UPI) innovation could be a new challenge?

Hypothetically speaking

If a customer is using, let's say Zomato app and opts for UPI method of payment, then the customer is invariably taken to the respective UPI app such as PhonePe or Google Pay. Once the payment has been made online, the customer is again taken back to the app, Zomato in this case, to complete the order. It is this additional step that results in multiple payment failures, due to several reasons, sometimes technical and at times human.

How will the UPI plugin change things?

It is this additional step that the UPI Plugin attempts to make redundant. Which means that the payment will take place within the app being used without having to go to a specific app like PhonePe or Google Pay.

Why do some in the industry have reservations?

A few apps and merchants are even slated to go live in the next few months. Payment gateway and processing firms like Paytm, Razorpay and Juspay have even enabled their merchants with the option of SDK (software development kit). On paper, UPI Plugin looks much simpler, faster and easier with the removal of another step in the digital payment process. But some from the industry haven't yet declared it as the permanent cure to all payment failures. PhonePe's Rahul Chari doubts if there's any actual technical benefit to improve success rates. "It shifts the onus of payment apps onto sponsor banks and the merchant application. This puts more burden and responsibility on the merchants." Charu further reasons in the blog that there could be operational issues, apart from the fact that, "It burdens the merchants rather than helping them focus on their core business."

Payment gateway and processing firms Paytm, Razorpay and Juspay have enabled their merchants with the option of enabling the SDK with the hope of improving success rates by up to 15 percent.

What if big companies make the move?

UPI leader PhonePe (which enjoys a staggering majority of market share at 47% of all such payments) and Google Pay, with a market share of 33%, fear the probability of a lot of customers not going to the UPI apps to complete their payments. If big companies like Swiggy, Myntra, Zara, Flipkart, Zomato opt for in-app payments, it will be a huge economic setback for these two leaders. PhonePe or Google Pay are yet to issue any statement on the matter and their possible role in case UPI Plugin has the success rate it claims.

The innovation has its challenges

Large merchants like Myntra, Zomato could have their reservation because UPI Plugin forces them to tie up with a single bank to create a merchant UPI account, making them too dependent on one bank. Multiple payment apps through multiple payment apps hedges the risk. Operational headache of the merchants could exponentially increase, such as customer support, data, dispute management, risk, compliance etc.

But any digital innovation has met with similar reservations, unfavorable industry forecasts and unwelcoming reviews. Let alone digital payment platforms, even online shopping faced discouraging predictions at one point in time. The rest is history.