Digital payment services company Paytm is planning to merge its wallet services with the proposed payment bank in the near future to comply with the norms of the Reserve Bank of India before launching banking operations.

According to a report in the Economic Times, the firm will merge the entity after receiving necessary regulatory approvals. "As per the directions of RBI, the company will transfer its wallet business to the newly-incorporated Paytm Payments Bank Limited (PPBL) after receipt of necessary approvals," the report quoted a spokeswoman of Paytm as saying.

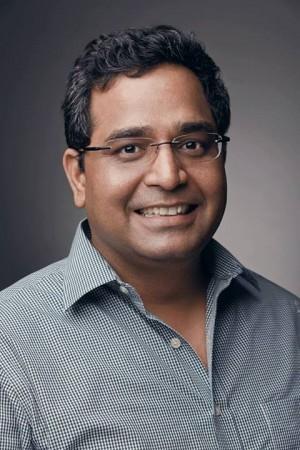

Paytm, which is owned by One 97 Communications, has two major businesses -- namely payments business and commerce marketplace. RBI has issued payments bank license in the name of Paytm founder Vijay Shekhar Sharma who holds 51 percent stake in the proposed entity with rest being held by One 97 Communications. According to reports, Sharma has invested Rs 112 crore for a majority stake in the payments bank.

"Banks have their own mobile wallets, so it should not be a problem for Paytm to have its wallet business merged with the payments bank business. However, in line with regulatory requirements, the company has had to segregate its e-commerce business from the payments business," the report quoted Bhavik Hathi, managing director of consultancy firm Alvarez & Marsal, as saying.

On the launch of operations of Paytm's payment bank, the report quoting company officials as stating that the company was in the process of obtaining final approval from the RBI and would commence operations post these approvals.

Interestingly, Paytm has emerged as a major beneficiary of the government's demonetisation move. According to the company, it has witnessed over 5 million transactions on a daily basis with a peak of Rs 120 crore worth of transaction on a single day after banning of high-value currencies.

In August last year, the central bank issued licenses to 11 entities, including Airtel, Paytm, FINO, Department of Post and Reliance Industries, to set up payment banks. Recently, Airtel was the first entity to start operations of its payment bank.

Payment banks will only accept deposits with no provision of giving out loans to clients. While it can open both savings and current accounts, credit card issuances are not allowed.