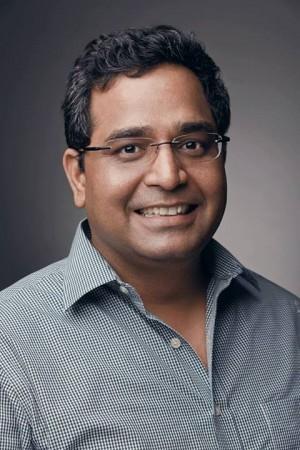

With its key backer's Chinese internet giant Alibaba and investment firm Ant Financial exiting the firm, Vijay Shekhar Sharma's Paytm Mall, which is One97 Communications' e-commerce division, has witnessed a roughly 99.5 per cent valuation collapse. Alibaba and Ant Financial are both leaving Paytm Mall, according to a statement released by the company.

The news follows the company's announcement yesterday that it will join the ONDC, signalling a shift away from traditional physical goods e-commerce. According to the company's statement, it will explore the export potential.

According to the resolution, Alibaba will exit with over $3.5 million and Ant Group will exit with over $1.8 million, and both will write off their interests. Paytm Mall will repay these investors at the current share price of Rs 459 a share, valuing the company at approximately $13 million. The company's worth has plummeted by 99.5 per cent since its peak in July 2019, when it was valued at $3 billion after eBay led a $160 million round.

In the face of fierce competition from Amazon, Flipkart, and Reliance, Vijay Shekhar Sharma's bet on offline-to-online commerce through Paytm Mall failed. Paytm Mall announced its shift to India's Open Network Digital Commerce (ONDC) on Monday, with a greater emphasis on e-commerce exports.

Keeping in mind our attention to building an open platform for e-commerce, our @PaytmMall ‘s business now be built on @ONDC_Official . It will be cost effective, scalable and bring even larger impact to small businesses. https://t.co/738it43YnV

— Vijay Shekhar Sharma (@vijayshekhar) May 16, 2022

Vijay Shekhar Sharma, in a Tweet, said, "Keeping in mind our attention to building an open platform for e-commerce, our Paytm Mall's business now be built on ONDC Official. It will be cost-effective, scalable, and bring an even larger impact to small businesses."