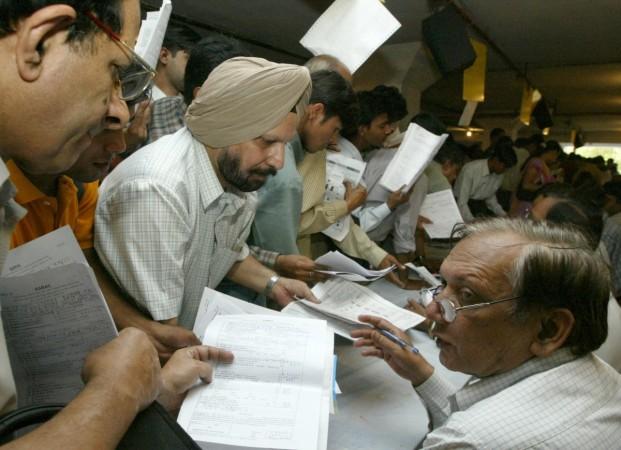

A total of 18,358 Indians earn more than Rs. 1 crore a year, according to interpretation of the income-tax data released by the Finance ministry on Friday, said Business Standard. The document revealed that there were 2.8 crore individual tax assessees during the year 2011-12.

Also called the Super Rich, the Rs. 1 crore club consisted of just 0.06 percent of the tax payers.

The income tax data, disclosed after a gap of 15 years, also pointed out that not everybody in this Super Rich category qualifies for the additional surcharge for the wealthy, as the surcharge, introduced in 2013-14, is only levied on taxable income and not on total income. Surcharge is 15 percent in 2016-17 fiscal, consistently increasing from 12 percent when it was introduced first.

The super rich tax is not limited to individuals alone but also firms.

Direct Tax

Only 0.07 percent or 21,819 entities (individuals and companies) out of the total 3.11 crore made up for 66 percent of the total direct taxes received in 2011-12. That is an amount to the tune of Rs. 2.56 lakh crore of the total Rs. 3.89 lakh crore received as direct taxes.

Further analysis noted that 63 of the entities declared business income of more than Rs. 1,485 crore on an average. Another 205 entities had business income of Rs. 2,198 crore on an average, said Business Standard.

Trends from Returns filed

Incidentally, the income tax data revealed that 55.6 percent of 3.11 crore tax return filers paid no tax to the exchequer as their taxable income stood below the threshold.

Sixty two percent or nearly 2 crore of the 3.11 crore return filers of 2011-12 fiscal, did not indicate any salary earnings, instead they had other sources of income from businesses, house property, interests, short term and long term capital gains tax, etc.

Amongst the salaried class, a huge chunk of returns (nearly 20 lakh) were filed by those who earned between Rs. 5.5 lakh and Rs. 9.5 lakh. Those earning between Rs. 2.5 lakh and Rs 3.5 lakh per annum followed as the second largest filers of return in 2011-12.

Professional Tax

Eleven lakh professionals, including chartered accountants, auditors, fashion designers, lawyers and medical service practitioners, paid direct taxes in 2011-12, said Business Standard.

A majority of people filing direct tax returns had income more than Rs. 50 lakh — the 'rich' category of earners. Professionals who fall into this 'rich' category will be eligible for presumptive tax from this fiscal (2016-17), where they need not maintain detailed books of accounts, said the news report.