Brent crude futures jumped close to $3 on Friday, January 3 to their highest since September after a US airstrike killed key Iranian and Iraqi military personnel, raising concerns that escalating Middle East tensions may disrupt oil supplies. Brent crude futures jumped nearly $3 to hit a high of $69.16 a barrel, the highest since Sept. 17. The front-month Brent March contract was at $68.25 a barrel, up $2.00, or 3 per cent, by 0258 GMT.

US West Texas Intermediate (WTI) crude futures rose $1.76, or 2.9 per cent, to $62.94 a barrel. Earlier, it touched $63.84 a barrel, highest since May 1. "The supply-side risks remain elevated in the Middle East and we could see tensions continue to elevate between the US and Iran-backed militia in Iraq," said Edward Moya, analyst at brokerage OANDA, in an e-mail.

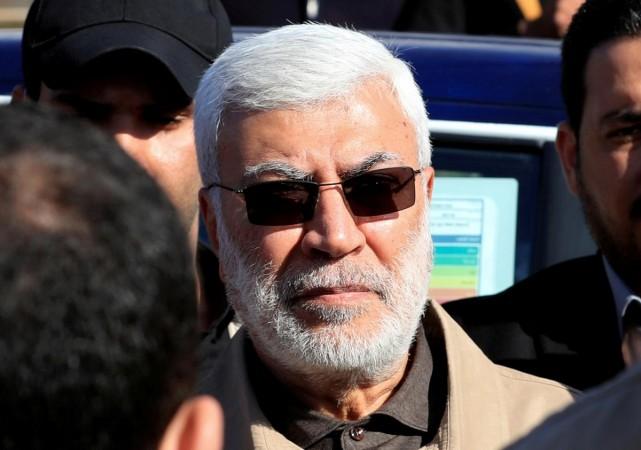

US airstrike kills Iran's Qassem Soleimani

An airstrike at the Baghdad International Airport early on Friday, January 3 killed Iranian Major-General Qassem Soleimani, head of the elite Quds Force, an Iraqi militia commander Abu Mahdi al-Muhandis, an Iraqi militia spokesman said. The Pentagon later confirmed it was a US airstrike that killed Soleimani.

Oil prices were also lifted by China's central bank saying on Wednesday it was cutting the amount of cash that banks must hold in reserve, releasing around 800 billion yuan ($115 billion) in funds to shore up the slowing Chinese economy. This came shortly after data showed China's production continued to grow at a solid pace and business confidence shot up.

Trade relation between China and US

"Oil prices still have room for further upside as many analysts are still having to upgrade their demand forecasts to include a rather calm period on the trade front," Moya said, referring to the warming trade relation between China and the United States. President Trump is likely to take a break on being 'tariff man' until we get beyond the presidential election in November."