State-owned power utility NTPC is all set to gain Rs 200 crore for putting up a good performance in thermal power generation for the year 2016-17. Out of its 16 coal-fired power projects, six operated at a plant load factor (PLF) in excess of 85 percent, entitling it to the incentive in line with the electricity regulator's scheme. It may be recalled that India is now a net exporter of electricity.

The six projects have a total power generation capacity of 13.6 GW.

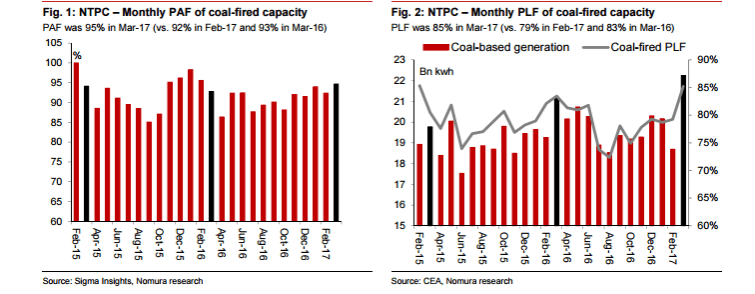

"Electricity generation in excess of 85 percent PLF was 4,010MUs, implying likely incentive-linked income at ~Rs 2bn, vs our forecast of Rs 2.5bn for FY17," Nomura analysts Anirudh Gangahar and Archit Singhal said in their note on Thursday.

The incentive scheme announced by the Central Electricity Regulatory Commission (CERC) for the period FY2015-19 envisages payment of 50paisa/KWh.

The analysts have upgraded the share price of NTPC to Rs 200, translating into an appreciation of 22 percent from the current market price of Rs 164 at around 1.55 pm on Thursday. The 52-week high for the stock is Rs 177.80.

Coal stock at NTPC thermal power plants have marginally improved, according to the analysts.

"In terms of coal inventory position, two plants aggregating 6GW capacity now have less than a week's inventory (vs three plants aggregating 8.3GW as of Feb-2017). Coal stock positions range between 1-28 days for pit-head plants and between 12-57 days for non-pit-head plant," they wrote in their note.

NTPC's operating performance last month and fiscal 2017 was better in comparison to other coal-based government power projects and independent power producers (IPPs).

"PLF (79.4 percent) of NTPC's coal-fired capacity remained superior to that of state-owned projects (56.2 percent) and private IPPs (58.6 percent) in Mar-2017. For FY17, NTPC's coal-fired PLF (at 78.8 percent) was significantly above that of state-owned projects (at 54.6 percent), private IPPs (at 55.7 percent). All-India coal-fired PLF for FY17 stood at 59.8 percent," Nomura analysts said.

In a related development, NTPC said that its board on Wednesday approved enhancing its planning borrowing from the earlier $4 billion limit to $6 billion "to part finance the capital expenditure on new / ongoing projects, coal mining projects, renovation and modernization of power stations and for other permissible end uses."

NTPC is the largest thermal power generating company in the country, with a coal-based installed capacity of 38,755 MW, apart from interests in solar power and coal mining.

The power situation in India has changed for good over the years, with the current situation hinting at a shrinking demand-supply gap.

"India currently has an installed capacity of 319 GW, against peak demand of 159 GW and another 87 GW of capacity already under construction. Energy deficit for FY2017 has come off to 0.7% and is no longer representative of a measure for demand-supply gap," Kotak Institutional Equities said in an update two days ago.

The BSE Sensex was trading 34 points higher at 29,369 at around 2.50 pm, led by HDFC, Maruti Suzuki and Adani Ports.