It was way back in 2016 that the UPI payment system was introduced in the nation as a humble pilot launch with 21-member banks to promote hassle-free real-time transactions. Ever since then the face of financial transactions has not been the same in India.

The Unified Payments Interface (UPI) seeped into grassroot levels at a speed that, perhaps, even surprised the organization introducing the system — National Payments Corporation of India.

So widespread has been the acceptance that small-time sellers with printed QR codes, placed alongside oranges and potatoes on their cart, do not raise a brow any longer. Nor do the street-food vendors or those selling wares on the pavement who can also be found using the digital payments system.

NPCI extends UPI services

Perhaps the only limitation hitherto experienced with real time digital exchange was the one owing to its borders, which is all set to be done away with as NCPI extends its UPI services to NRIs holding Non-Resident External (NRE) or NRO accounts. The move allows Indians anywhere to perform instant transactions from their smartphones through UPI linked to their international mobile numbers.

Step-wise guide

- The first step remains the same, only in this case the NRIs will link their international mobile numbers to their NRI bank account.

- They then have to choose one of the UPI-powered applications (in this case the one that supports international mobile numbers).

- After the above formalities have been ticked off, then the onboarding process needs to be completed, which differs from bank to bank.

- Post the above steps, the mobile number of the user will be verified and a new UPI ID will be created.

- After selecting the bank account number the process shall be considered complete for submission.

With NRIs being brought into the ambit of UPI, they will be able to conduct business with the same ease that Indians residing in India can; i.e send money in Indian rupees to Indian merchants and UPI IDs. The NRIs will also be able to make payments by scanning QR codes, send money directly and instantly using bank or account numbers.

The limitations

However, the NRIs will not be able to make transactions in foreign currency since UPI transactions are only valid in INR. Linking multiple accounts to one UPI ID is also not permitted as each account needs a unique UPI ID. For anyone residing abroad and wanting to send money to their family, friends or a seller in India, the recipient must have an Indian mobile number and a UPI ID linked to an Indian bank account.

India leads and how

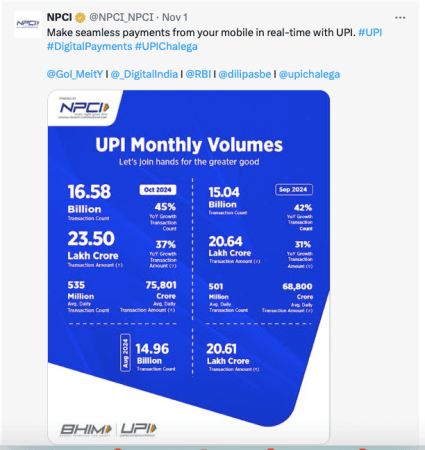

According to the Economic Intelligence Unit Report 2021, India leads the way in digital payments and how. The report says that UPI made India a leader in the global real-time payment system. The Indian market is closely followed by that of China and South Korea. Even though the statistics vary slightly, but as of the second quarter of this year, reportedly there were already 350 million active users in India and over 340 million QR codes at various merchant locations. While over a hundred mobile applications are a part of the UPI system, players like Google Pay, WhatsApp, Amazon Pay, PhonePe occupy a major chunk of the market.

Related