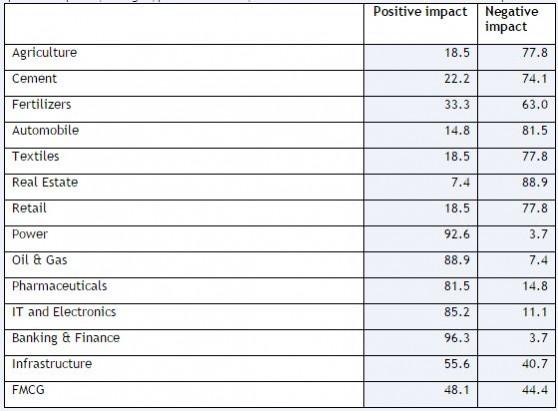

Small and medium enterprises (SMEs) would continue to feel the pinch of demonetisation with declining sales volume even for the January to March quarter (the last quarter of the current fiscal year 2016-17) as a majority of the industry believes that agriculture, cement, fertilisers, automobile, textiles, real estate and retail will be hit in the short term.

Indian auto sales plunge to lowest numbers in 16 years as demonetisation bites

However, power, oil and gas, pharmaceuticals, IT and electronics and infrastructure will perform as large and well-organised sectors stand to benefit in the long term, according to an ASSOCHAM Bizcon survey.

Meanwhile, rural consumption and job creation will face a negative impact on account of demonetisation.

"When the economy is in a state of flux, it is quite a challenge to get the real picture on the ground. For the present, the impact is seen on certain sectors, while others escaped. Hopefully, things would get normalized sooner than later with the Budget being seen as a big trigger," Assocham secretary general DS Rawat said.

The survey points out that 81.5 percent of the respondents felt SMEs have been hit and would still suffer the lingering effect for one more quarter, while an equal number said for large enterprises, the impact would be positive.

A large number of respondents felt that the impact could also be seen on the order book position with investment graph not showing much of an uptick for the January-March quarter, retaining almost similar stance as in the previous quarter. Additionally, approximately 92 percent of the respondents said demonetisation would have a positive impact on inflation. Respondents also sounded downbeat on consumer confidence and demand, particularly in the rural India.

Talking about what measures should the government take to revive industrial growth, they said reducing the cost of borrowing, containing trade deficit and indirect tax reforms as well as lowering of income tax rate would be beneficial.