Music Broadcast Ltd. (MBL), which operates FM channel Radio City 91.1 FM, raised Rs 146 crore from anchor investors by issuing 44 lakh shares at Rs 333 per share, as part of its initial public offering (IPO). The public issue in the price band of Rs 324-333 per share opens on Monday (March 6) and closes on Wednesday.

The Rs 500-crore IPO seems to have received good ratings from brokerages, most of whom have recommended 'subscribe.' The IPO comprises offer for sale (OFS) of 26.59 lakh shares by the promoters and fresh issue of shares worth about Rs 400 crore.

Highlights of the IPO (with inputs from Angel Broking, Motilal Oswal Securities):

Industry at a glance

The radio industry is expected to grow at a CAGR of 16.9 percent between CY 2015-20 to Rs 4,360 crore (Ficci-KPMG report) driven by commencement of new radio stations, increase in listenership in tier-II & tier-III cities and an overall increase in ad rates.

About Radio City/MBL

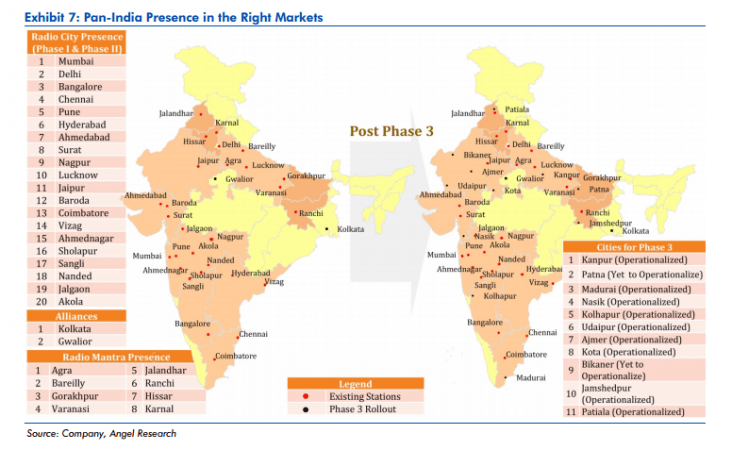

MBL is part of Jagran Prakashan Ltd., which has interests across various segments in media business including print, out of home, digital and radio. One of the first private FM radio broadcasters in India, it has 39 frequencies currently (37 operational) including eight stations acquired from Radio Mantra and 11 acquired via Phase III auctions.

Geographical presence, reach, market share

Radio City is present in 12 out of the top 15 cities in India by population. It has about 49.6 million listeners spread across 23 cities (according to a survey conducted by AZ Research), making it the No. 1 FM Radio station. It nearest competitor is Entertainment Network India Ltd (ENIL) with 40.5 million listeners.

Business USP

Radio City occupies an advantageous position from advertisement standpoint. Its wide listenership enables to charge ~30 percent more advertising rates than its peers and 12-15 percent higher charges than its closest peer. This reflects in its operating margin at a high 34 percent.

Financials

For the financial year 2015-16, MBL earned net profit of Rs 43 crore on total revenues of Rs 232 crore. The net profit was higher in FY2015 at Rs 47 crore on total sales of Rs 201 crore.

The corresponding figures for the first half of the current fiscal were Rs 30 crore and Rs 137 crore, respectively.