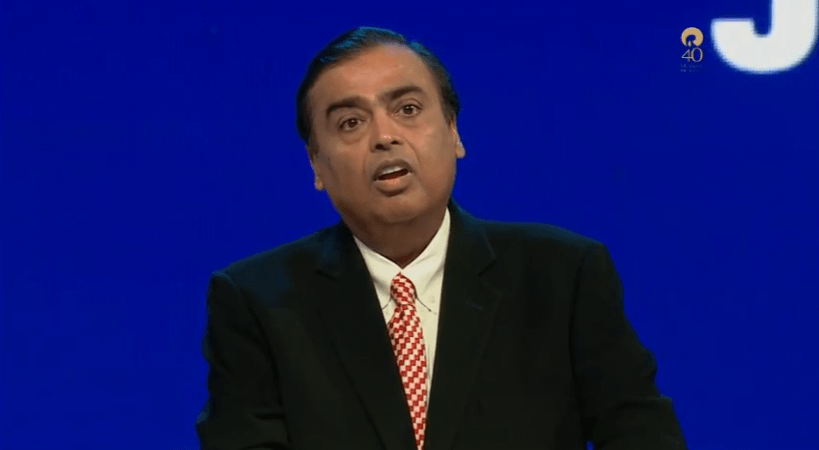

Reliance Industries Chairman Mukesh Ambani on Monday said the company's retail arm will soon unveil Reliance New Commerce, an initiative to digitally connect kirana stores across the country.

Speaking to shareholders at RIL's 42nd Annual General Meeting, Ambani said that the trials of Reliance Retail's digital commerce venture have delivered positive results. "This user-friendly digital platform is designed for inventory management, customer relationship management, financial services and other services," he added. According to the RIL Chairman, the initiative is aimed at digitally empowering kirana stores, including those in smaller towns

Speaking on other plans of the conglomerate, Ambani said only jet fuel and petrochemicals will be produced at its mega Jamnagar refinery complex and that he has laid out a roadmap to make the group a zero net-debt company in just 18 months.

Ambani also said that Saudi Aramco will acquire 20 percent stake in RIL's oil-to-chemical business.

New Jamnagar strategy

Billionaire Ambani's new Jamnagar strategy means that the refinery would gradually reduce the production of auto fuels such as petrol, diesel, the consumption is expected to decline with the penetration of electric vehicles. Already, in the first quarter of FY20, fuel demand has shrunk resulting in a double-digit fall in India's crude imports in June.

"Jamnagar shall be the refinery icon of the world with the best-in-class performance," RIL said in its annual report.

It said the firm's mission was to "ensure the Jamnagar refinery is future-ready with a strategic transformation to optimal oil-to-chemicals".

The RIL refinery currently converts crude oil sourced from around the globe into petrol, diesel, LPG, aviation turbine fuel (ATF), LPG, naphtha and other value-added fuels. Under the revised strategy, crude oil will be used to convert it into petrochemicals and ATF.

The new RIL strategy is devised on the basis of ground realities. Globally, refining and marketing earnings have declined to almost 20 per cent in 2018. At $9.2 per barrel, though RIL's refining margin has remained relatively strong even in a dynamic and volatile market, future is indicating tougher days that need an early preparation.

Already in the country, there is surplus refining capacity and public sector undertakings (PSUs) are adding new production lines that will create additional capacity. The government's electric vehicle focus is also expected to further dent the demand.

The fundamentals of the Jamnagar oil-to-chemical strategy are to employ advanced molecule management to upgrade the refinery's intermediate streams by value.

"The oil-to-chemical programme is a roadmap implemented over a long time horizon, based on the market outlook and price triggers for refinery fuel products. The ultimate goal is to achieve greater than 70 per cent conversion of crude refined in Jamnagar, to competitive chemical building blocks of olefins and aromatics," the annual report said.

RIL plans to preserve as well as upgrade existing refinery margins while maximising asset utilisation for a sustainable competitive cost of chemicals.

It has developed a disruptive technology innovation, a Multizone Catalytic Cracking (MCC) process, which converts a wide range of feedstock to high-value propylene and ethylene in a single riser.

Implementing multi-billion dollar projects

"All refined products priced below crude shall be eliminated for chemicals at the initial stage. Final fuel de-risking shall target the elimination of gasoline, alkylate and diesel, synchronised to the global evolution of E-mobility and transport fuel demand decline," it said.

As part of the oil-to-chemical strategy, RIL is already implementing multi-billion dollar projects. The company has built the world's first-ever Refinery Off-Gas Cracker (ROGC) complex of 1.5 million tonnes per annum and is importing ethane from the US to produce petrochemicals.

Roadmap to become zero net-debt company

Meanwhile, Mukesh Ambani has also laid out a roadmap to make the group a zero net-debt company in just 18 months. Ambani's statement came in the wake of rising debt at the group level that reached a level of group Rs 1,54,478 crore in the last financial year.

Addressing the group's 42nd AGM in Mumbai, Ambani said he was confident of growing the company's consolidated earnings 15 per cent annually over the next five years.

He said the group's telecom vertical Reliance Jio and retail venture Reliance Retail would account for 50 per cent of the company's earnings soon.

The RIL chairman also assured shareholders that they would continue to get periodic bonus issues and higher dividends once the group became debt-free.

Shares of the company are up 20 percent since the last AGM in July 2018, but have underperformer Nifty by 11 per cent over the past three months. The stock has been down 9 per cent in the last one month.

The company accumulated a gross debt of more than Rs 2.87 lakh crore, as it feverishly diversified into consumer-focused businesses in retail, telecom and e-commerce over the past few years besides majorly upgrading the core refining and petrochemicals businesses.

In FY19, the company's finance cost more than doubled to Rs 16,495 crore from Rs 8,052 crore in the previous year.

The group attributed the increase primarily to the commencement of digital services business, petrochemical projects at Jamnagar and higher loan balances.

Ambani told the AGM that RIL has transferred its telecom infrastructure assets into two separate infrastructure trusts for a consideration of Rs 1.25 lakh crore with the intention of raising money from large global institutional investors.

"We have received strong interest and commitments from reputed global investors and are confident that these transactions will be completed by the end of this financial year. Post this, we ended last year with net debt of Rs 1,54,478 crore," he said.

(With IANS inputs)