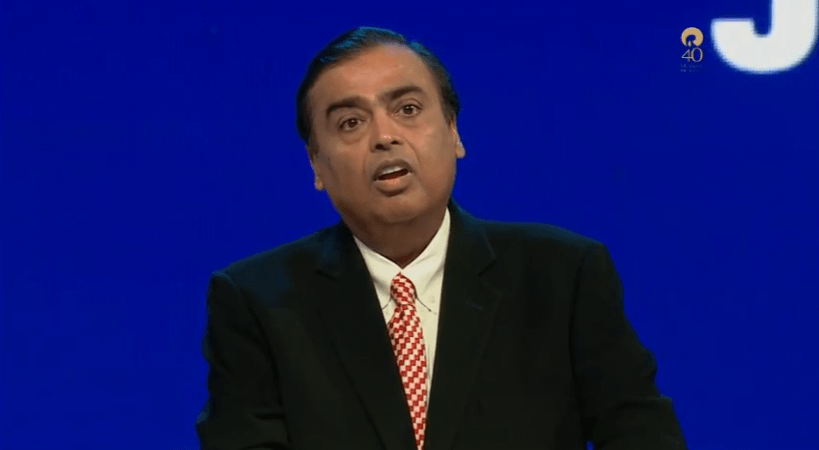

The Securities and Exchange Board of India (SEBI) has slapped Rs.15 crores on Reliance Industries Limited (RIL) Chairman Mukesh Ambani for alleged manipulative trading in shares of Reliance petroleum limited in 2007. The market regulator has also fined RIL Rs. 25 crores in the same case with a similar charge. SEBI has also levied fines of Rs 20 crore on Navi Mumbai SEZ and Rs 10 crore on Mumbai SEZ in along with Mukesh Ambani and RIL.

What is the issue?

As per a report in The Financial Express, the SEBI investigation related to the trading in the Reliance Petroleum Limited (RPL) scrip that was merged with RIL in 2009. In March 2007, the Board of RIL approved the operating plan for the year 2007-08 and capital requirements for the next two years, approximately Rs. 87,000 crore, among other items. RIL later agreed to sell about 5 percent of its RPL shareholding.

The SEBI order highlighted, "Subsequently, RIL admittedly appointed 12 agents, between October 2007 to November 2007, to undertake transactions in the November 2007 RPL Futures (settlement period November 1- November 29, 2007) on its behalf." It also claimed that, on behalf of RIL, the 12 agents appointed by RIL took short positions in the F&O Segment, whereas RIL pursued transactions in the cash market of RPL shares.

This is done to make an undue profit of around Rs. 513.12 crore, SEBI said in its order. The order further added that "RIL had entered into a well-planned operation with its Agents to corner the open interest in the RPL Futures and to earn undue profits from the sale of RPL shares in both cash & futures segments and to dump a large number of RPL shares in the cash segment during the last ten minutes of trading on the settlement day resulting in a fall in the settlement price."

Will the order impact RIL share?

Market experts have argued that the order is unlikely to affect RIL share on Dalal Street. Sanjiv Bhasin Director, IIFL Securities said that the news will be consumed and with the bullish momentum, markets will move on.

(International Business Times has reached out to Reliance Industries Ltd. for its comment on the development. This story will be duly updated after RIL's response)