The move to monetise roads and raise funds to fuel road laying will help the National Highways Authority of India (NHAI), to drive around criticism of overspending. The NHAI has been spearheading the country's rapid road network expansion for the past several years.

A recent 'suggestion' from Prime Minister Narendra Modi's office to the NHAI, to slow down road expansion in view of road bumps ahead for the national economy, had been construed as cautionary advice.

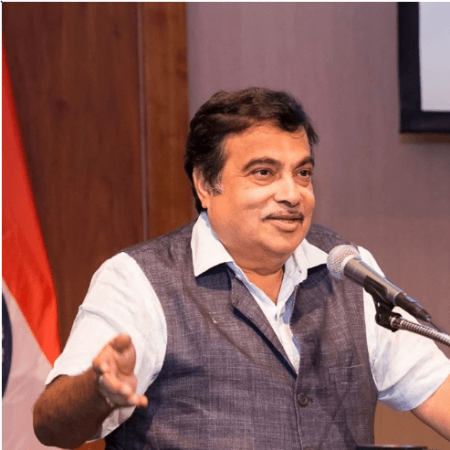

Nitin Gadkari, the Minister of Road Transport and Highways and Shipping, had said the Prime Minister's Office (PMO) had only made a suggestion and it did not mean his ministry would go slow on network expansion.

The letter from the PMO, claiming that the NHAI is stuck with the unplanned and excessive expansion of roads declared as national highways, had led to scepticism in the road building industry. The PMO suggested that the NHAI revert to the traditional build, operate and transfer (BOT) model that is less burdensome for the government.

After the breakneck speed of 2019 financial year, the pace of activity has slacked off with the only 500 km of road projects awarded with half of FY20 getting over soon, according to a Livemint report. Experts have already expressed doubts about NHAI's ability to meet the target of building 7,000 km-8,000 km roads this year.

It is feared that the PMO's suggestion of NHAI discarding the hybrid annuity model (HAM) and engineering, procurement, construction (EPC) formats to avoid "unsustainable" investments may drive away investors. The confusion is already telling on the sector while the country is in the midst of a general slowdown, except in the IT sector.

The traditional BOT projects in which the entire equity is borne by the road developers have dragged companies into debt, worsened by litigation over approvals and overestimation of traffic, the Livemint report quotes Binod Modi, an analyst at Reliance Securities Ltd., as saying.

Public sector lenders have placed lending for BOT project in the current form on the negative list. In a BOT project, the developer builds, operates and then transfers the project to the government, while the HAM model requires a 40 percent upfront government payment. The developer raises the balance of project cost. About 92 percent of the awards at present are on the HAM and EPC models, in which most of the financial burden is on the NHAI.

The PMO's suggestion to reassess the financial viability of projects to be awarded, in the light of rising land acquisition and construction costs, may delay ordering, the report says quoting a note by investment firm Nomura. "An attempt to restart BOT (toll) in a big way will only result in a slowdown of ordering, potentially leading to Rs 100 lakh crore of infra Capex target for the next five years being missed by the central government," it said.

The PMO's letter was seen as a dampener on the enthusiasm that a Gadkari announcement that Rs 15 trillion would be spent on highways. Industrial observers are worried that despite Gadkari's remark that the PMO had only made some suggestions the development could drive away investors who fear uncertainty the most.