Private telecom operators understated a total of Rs 61,064.56 crore in adjusted gross revenue (AGR) during the financial years starting 2010-11 to 2014-15, according to report on underreporting of revenues by the telecom sector released by the Comptroller and Auditor General of India this week.

The CAG audited six telecom companies — Bharti Airtel, Vodafone, Aircel, Idea, Reliance Communication and Sistema Shyam Teleservices Ltd (SSTL), and said that with the exception of SSTL the other five operators had shown a short payment of revenue to the exchequer to the tune of Rs 7,697.62 crore.

According to the report, the netting of revenue from infrastructure sharing and non-inclusion of forex gains, interest income and sale of investment also led to understating of revenue.

The interest due on the short paid revenue share, for the period up to March 2016 was Rs 4,531.62 crore, the CAG report accessed by International Business Times said.

The audited companies had understated their license fee (LF) and weighted spectrum usage charge (SUC), which was fixed last year at a minimum of 3 percent of revenues.

The report said the understatement was due to "netting off of revenue" on promotional schemes such as free talk time and discounts paid to postpaid subscribers on roaming services, besides accounting adjustments for commission or discount paid to distributors and agents.

As part of the accounting readjustments, these promotional offers were illegally deducted from the prepaid revenue services, the CAG report said.

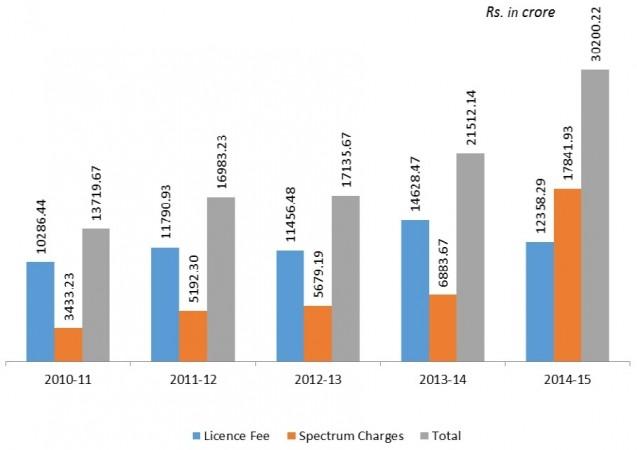

Revenue share collected by Department of Telecom (2010-11 to 2014-15):

When freebies went off the books

During the period falling between 2010-11 and 2014-15, the report said that free air-time and other promotional offers worth Rs 2,385.35 crore given to customers was not recognised in the gross revenues or AGR.

"Since offers to customers like free airtime is part of overall commercial strategy to enhance business, the costs of such offers/discounts/rebate were in the nature of expenses. Further as per licence agreement service revenue should be shown gross without any setoff," the CAG report noted.

CAG had raised under-reporting of revenues across various heads with the managements of the telecom companies and said that their replies were not acceptable since these freebies were being issued to customers as part of the overall commercial strategy of these companies to enhance business. "...therefore, they were in the nature of expenses and setoff for related items of expenses were not allowed as per the licence agreement," CAG said.

It also noted that details of the promotional offers were not turned over to it by the companies concerned. Noting that airtime is not a free commodity, the CAG said that telecom companies were foregoing revenues on promotional offers and other freebies instead of booking them as expenses. This was a clear avoidance of license fee and spectrum usage charges, the CAG said.

Short payments on LF and SUC fees to the government between the fiscal years 2011 and 2015 amounted to Rs 195.17 crore and Rs 133.33 crore respectively.

Under the New Telecom Policy (NPT) of 1999, which came into effect from April 1999, the revenue sharing regime was introduced in the Indian telecom sector. Under the NPT's revenue sharing system, telecom service providers are required to pay a percentage of their Adjusted Gross Revenue (AGR) as annual licence fee to the government.