The triple whammy of rising dollar, spiking US bond yields and high Brent crude continues to impact Indian equity markets, says V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

The cues from the US also are negative. It appears that the market is pricing in a 'higher for longer' rate regime in the US, which is not favourable to equity markets in the near-term, he said.

The 'buy on dips' texture of the market which took the Nifty beyond 20,000 has now changed to 'sell on rallies', he said.

Bulk of the selling has been coming from FIIs who have cumulatively sold in the cash market for Rs 21,287 crore in September, so far. Since the dollar index is now above 106 and the US 10-year yield is strong around 4.55 per cent, FIIs are likely to continue selling, rendering the market weak, he added.

Large banking stocks are likely to remain weak on FII selling. Long-term investors can use this weakness to buy high quality private banks and the leading PSU banks since the banking sector will continue to do well, going forward. Importantly, valuations in the banking segment are fair, he said.

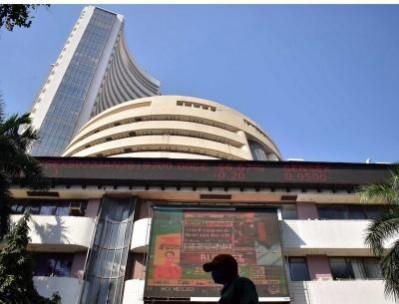

BSE Sensex is trading down 53 points at 65,892 points on Wednesday.

(With inputs from IANS)