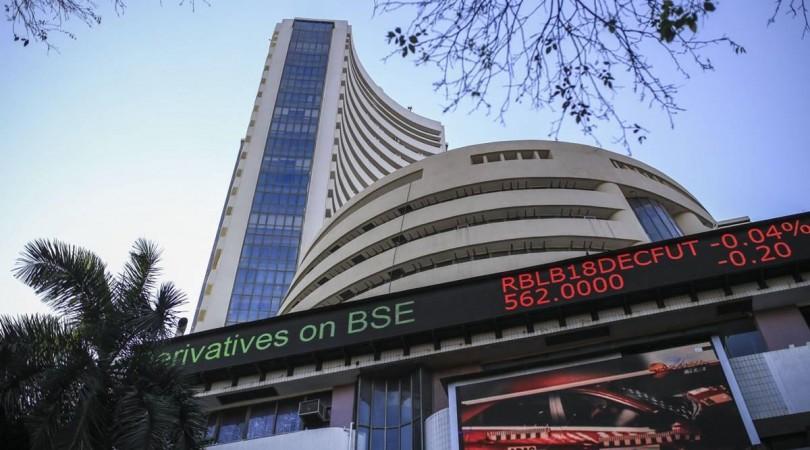

The Indian stock market traded on a flat-to-negative note for the second consecutive day on Thursday following a similar weak trend among its global peers.

The Centre's move to keep small savings rate unchanged for the July-September quarter to offer the common man relief from lower savings earnings amid the pandemic, however, remained neutral to trigger market response.

Around 10.10 a.m., the BSE Sensex was trading at 52,473.25, lower by 9.46 points or 0.02 per cent from its previous close of 52,482.71. It opened at 52,638.50 and has so far touched an intra-day high of 52,638.50 and a low of 52,422.28 points.

Analysts are of the view that the global markets are eyeing the release of the US jobs data for June. The data would be crucial for the US Federal Reserve's monetary policy decision. The Nifty50 on the National Stock Exchange was trading at 15,723.60, lower by just 2.10 points or 0.01 per cent.

The top gainers on the Sensex were Bajaj Auto, Mahindra & Mahindra and Kotak Mahindra Bank. On the other hand, the major losers were UltraTech Cement, IndusInd Bank and Infosys.

Manish Hathiramani, technical analyst with Deen Dayal Investments said: "The Nifty has a stiff resistance at the 15,900 level and until we do not get past this, we cannot move to higher levels. 16,100 is the next target for the index and that target is active as long as the market does not break the support of 15,400."

The Centre has kept small savings rate unchanged for the July-September quarter to offer the common man relief from lower savings earnings amid the pandemic.

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)