Luxury shoe and bag retailer Jimmy Choo surprised the markets on Monday by putting itself for sale, looking for lucrative buyers. The popular British go-to brand among celebrities, Jimmy Choo said that it had "decided to conduct a review of the various strategic options open to the company to maximise value for its shareholders." It said it was looking for offers for the business.

"The board of Jimmy Choo announces today that it has decided to conduct a review of the various strategic options open to the company to maximise value for its shareholders and it is seeking offers for the company," the firm said in a statement.

The iconic retailer, which is valued at £700 million, could attract buyers from rival luxury houses, including buyers from Chinese, Middle Eastern and Russian regions, BBC reported. The shoe retailer has reportedly witnessed slow sales in recent years.

The firm's decision was backed by its independent directors and JAB Luxury, its majority shareholder with a stake of 68 percent. JAB Holdings is also an investor in Krispy Kreme doughnuts and Reckitt Benckiser.

Jimmy Choo's shares jumped 10 percent to a record high of 186.25p after the news of its sale broke. The company is now valued at £720 million. The firm, in 2014, floated on the stock market at a price of 140p a share, valuing at around £550 million.

Shares in Jimmy Choo jumped 10% to a record high of 186.25p on the news, valuing the group at more than £720m. The company floated on the stock market in 2014 at a price of 140p a share, valuing it at about £550m.

The firm was co-founded by Malaysian shoemaker Jimmy Choo and former Vogue journalist Tamara Mellon in 1996. Choo trained at the renowned Cordwainers Technical College in London. The brand gradually grew in popularity and found its dedicated client of celebrities including musician, actresses and even royalty.

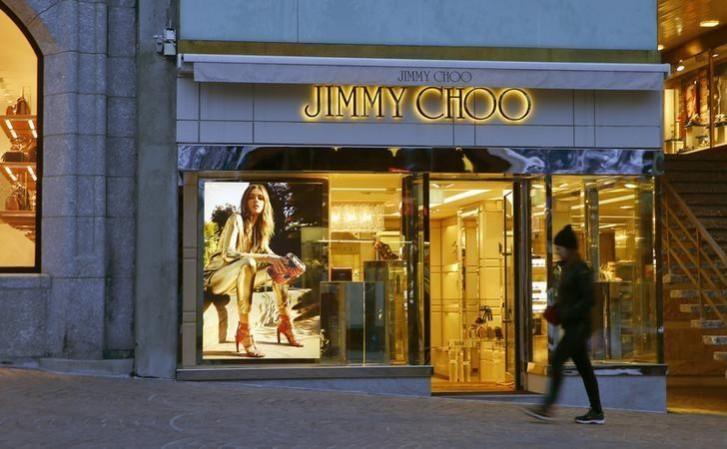

The popular retailer runs around 150 stores across the world. It opened 10 stores last year and refitted 16 shops.